Today I ran out of spoons and I didn’t realize until I started my walk to work and I started tearing up over listening to this podcast about people going for walks. Now there were some touching stories but I even got a bit teary feeling grateful over my morning coffee. 😭. So yeah, ok… Continue reading How I recharge

Month: October 2020

The 1 page CV

How many pages should you Resume/Curriculum Vitae have? I’ve always liked to keep mine below 2 pages and I’ve regularly experimented with a 1 page one. However different countries will have different expectations. And the CV is a relic from the past. Is it all that useful anymore? My 1 Page CV This here is… Continue reading The 1 page CV

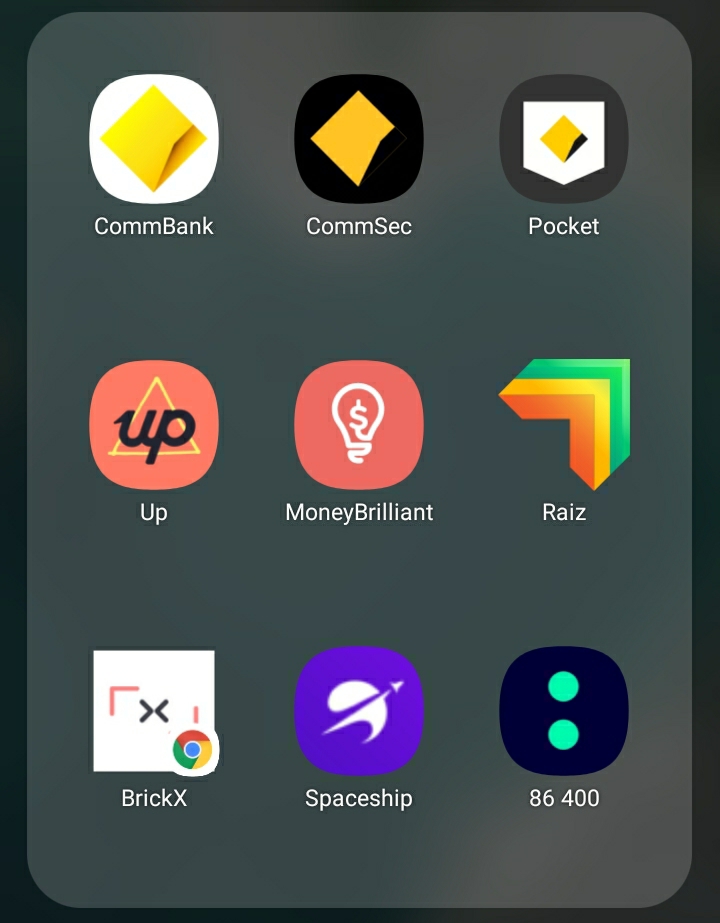

Review of Finance Apps

I’m studying to be a financial advisor and I’ve been exploring many of the mobile apps out there that can be used to help manage finances. This post is a review of the ones I’ve used so far. My preferred apps are listed first. This is NOT financial advice or a product recommendation, a professional… Continue reading Review of Finance Apps

A day in the life of a mobile app tester

A few days ago I posted on LinkedIn that I have hardly written any test automation code in the last year: And I had a few people ask, “how do I test during a code review?”. So I thought I would dive deeper into what an average day for me looks like. My Role; Software… Continue reading A day in the life of a mobile app tester

Windfalls of cash

I’ve gotten 3 windfalls of cash recently; my tax return (1.5K) my bonus from work (5k after taxes) 10k from super/retirement fund this post is a reflection on what I’ve done with that money. All numbers are in AUD. This is not financial advice, a professional can help you figure out the best approach for you. Show… Continue reading Windfalls of cash

Tech Twitter dumpster fire

Today, tech twitter is complaining about rocks and interview: And there’s a few people wish for an easier way to find #BadTechTweets

Testing Archives – October

Wow, we are just as close to 2070 as we are far from 1970. How did they test software 50 years ago? You’ll be surprised to find out, very similarly to how we do it today. The main difference with testing approaches today is the access to technology is greatly improved. Nearly every developer has… Continue reading Testing Archives – October

Lifestyle Plan

How much does it cost to be you? This blog post is a walkthrough of how I manage my finances so I can answer the question, how much does it cost to be me? I’ll be doing a budget spreadsheet for the month of October to come up with a number for my minimum living… Continue reading Lifestyle Plan

Early Access to super

This is not financial advice. This is a story of how I applied for 10k release from my retirement savings and what I spent that money on. Earlier this year, the Australian tax office allowed Australians the ability to withdraw up to 10k from their superannuation if they had been impacted by the pandemic financially.… Continue reading Early Access to super

How I built a 13k portfolio over 12 months

Disclaimer; this is not financial advice. This is a story about how I put aside a small amount of money each pay and how I invested it into a portfolio. I also work/have worked for a few of the companies mentioned in this blog. The TLDR; I put aside a percentage of my pay into… Continue reading How I built a 13k portfolio over 12 months