Now that I’ve paid off my credit card debt (Woo this feels awesome and is a huge relief), I’m now working on my next financial goal:

Maximise concessional contributions into super

This is not personal financial advice, this is a walkthrough of my next financial goal.

Table of Contents

Why this goal?

It is the most tax effective way for me to save for the future, and I can withdraw up to 50K under the first home super savers scheme. These contribution caps expire after 5 years, so I might as well use them.

Concessional contributions are pre tax, meaning they are only taxed at 15%. This is a lot cheaper than the 30% effective tax rate that I pay on my income.

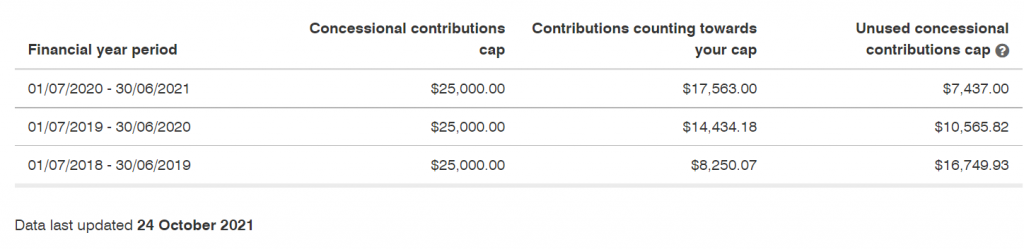

Unused concessional contributions

I’ve logged into the ATO and checked my previous unused caps.

To be able to use the unused contributions, I need to use all of this years contributions first before using previous years amount. And then it’ll use them from oldest year (2018-2019 in this case). Here are my left over concessional contribution limits:

| concessional contribution | |

| 2019 | $16,749.93 |

| 2020 | $10,565.82 |

| 2021 | $7,437.00 |

| 2022 | $18,264.94 |

| 2023 | $27,500.00 |

| 2024 | $27,500.00 |

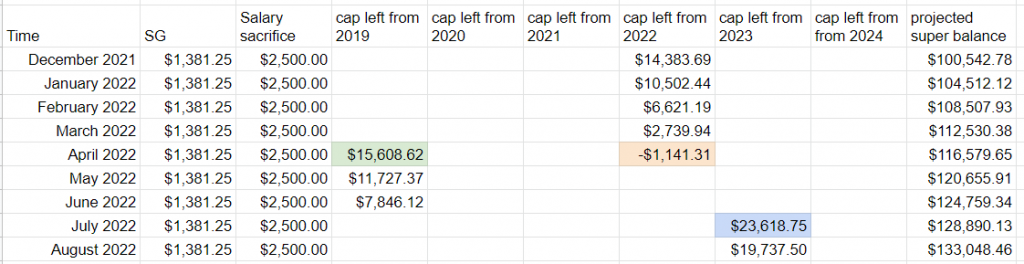

Calculating when I’ll use all of the caps

Calculating when I’ll catchup was a little tricky (it’ll be around June 2024 assuming current financials stay in place). I’m salary sacrificing $2,500 per month. I start by deducting my employer contributions (SG) and my salary sacrifice amount until I’ve used all of this years cap.

Next I deduct that amount from the oldest years cap. When a new financial year starts I start from a new year cap limit. I rinse and repeat this until all of the caps are used up. You can see the spreadsheet here in more detail.

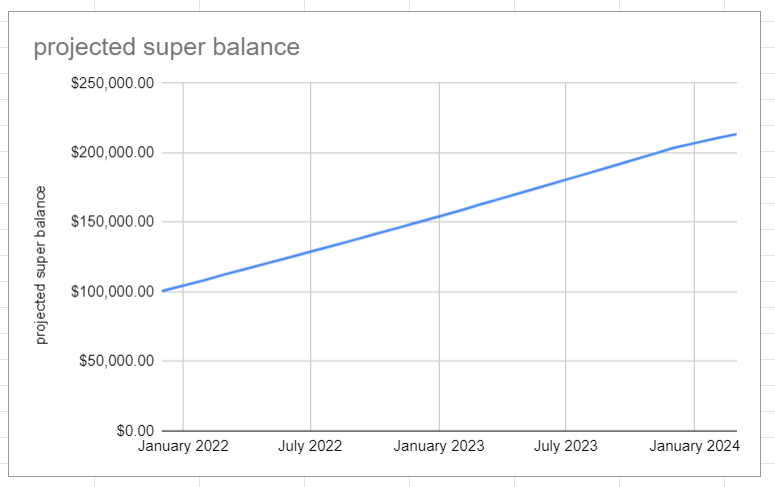

Super balance

This should see my super grow from 100K to over 220K in 2.5 years. That’ll still leave plenty of funds after I withdraw 50K under first home savers.

I haven’t adjusted for inflation with this growth projection as it’s only over 2 years.

Taxes saved

I would save 5.5K by doing this. My income tax before the salary sacrifice is $46,395, after the salary sacrifice I reduce my income tax to $37,145. I pay $3,750 in taxes on the extra contributions into super. This nets me 5.5K better off (46,395 – 37,145 – 3,750).

You can copy this spreadsheet to calculate how much tax could be saved by salary sacrificing into super.

Summary

I love super. I think it’s awesome. I withdrew 10K from super last year to pay off a credit card and to start learning about investing. Here is how it’s invested (I’m with sunsuper):

| Investment options | Allocation |

|---|---|

| Australian Shares – Index | 30.00% |

| International Shares – Index (unhedged) | 50.00% |

| Emerging Markets Shares | 10.00% |

| Australian Property – Index | 10.00% |

| Total | 100.00% |

I’d highly encourage you to check out your own retirement savings and see how it’s all going. Moneysmart has this great calculator (they will adjust for inflation by default though). I’m looking forward to writting more on this topic.

1 comment