If you hang out in the finance spaces online, you may have heard of FIRE (financial independence retire early). The aim is to reduce your expenses, save a shit ton for some time and live off the investment returns from all of your hard work.

This is not personal financial advice and you should seek out a professional if you’d like to learn more.

I personally don’t like the retire early notion. I imagine I’ll be doing some sort of work until I kark it because I don’t like to sit still. However the financial independence part is really appealing.

Table of Contents

Coast FIRE

I watched a video about Coast FIRE recently, the premise being you don’t need to retire early but you can build up savings now such that you can coast financially in retirement.

Goal: 300k in super by the age of 40

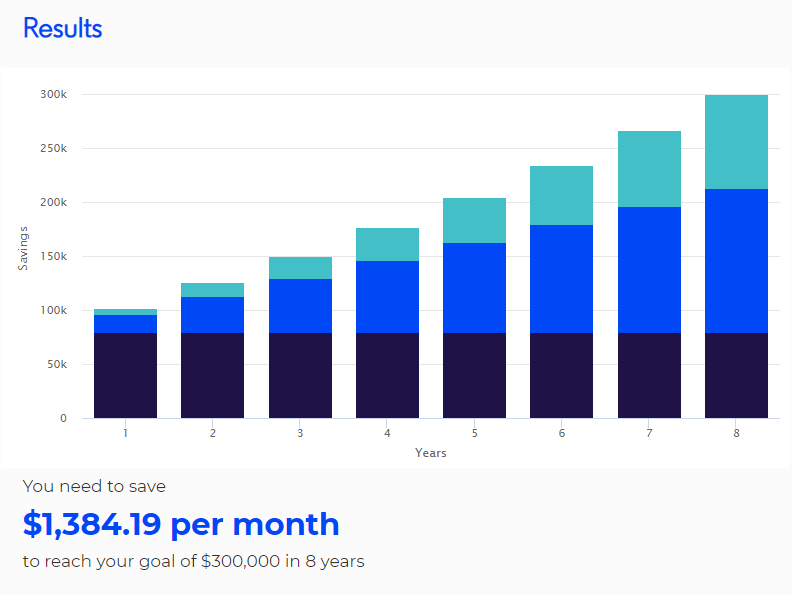

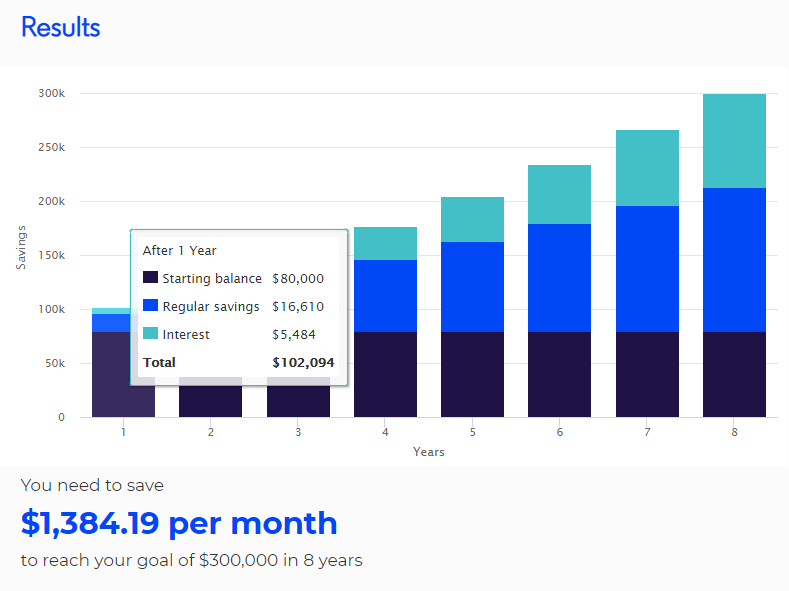

I’m currently 31, turning 32 in June. I have 80K in my super fund (superannuation is Australia’s retirement savings scheme). Say I want to have 300K in my super by the age of 40. I would need to add $1400 per month over 8 years to achieve that goal.

If I maximize the concessional contributions of $27,500 each year I’d contribute $2,290 a month which would easily exceed this target. This would be $1,945 a month after the 15% tax on concessional contributions into super.

Why 300K by 40?

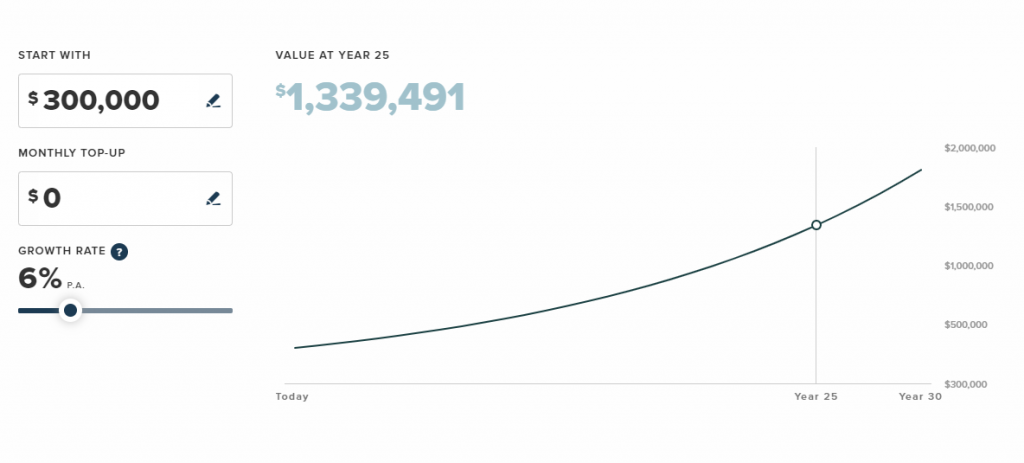

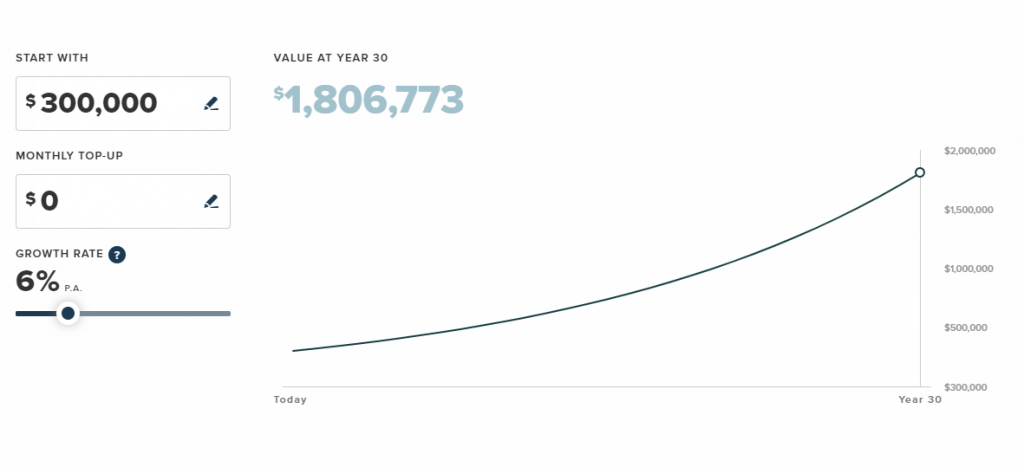

If I had 300K in super by the age of 40 and did nothing else (no more contributions and took work pretty easy), it could be $1.3 million by the time I’m 65 or 1.8 million by the time I’m 70.

This is assuming 8% growth and 2% inflation, hence the overall 6% growth projections.

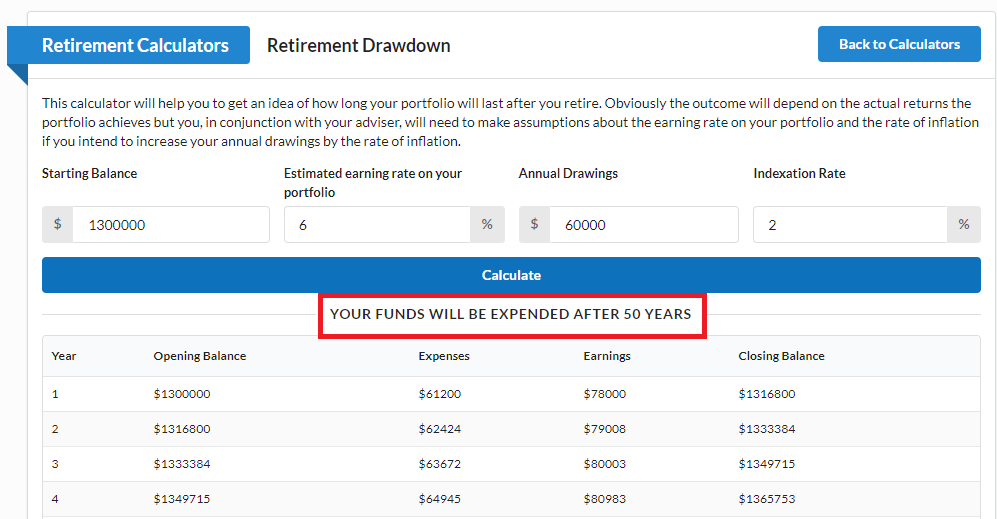

1.3 million at 65

1.3 million could last 50 years if drawing down 60K a year in retirement (assuming 6% investment return and 2% indexation rate). That’s definitely a very comfortable retirement for me considering my current lifestyle expenses are around 52K a year.

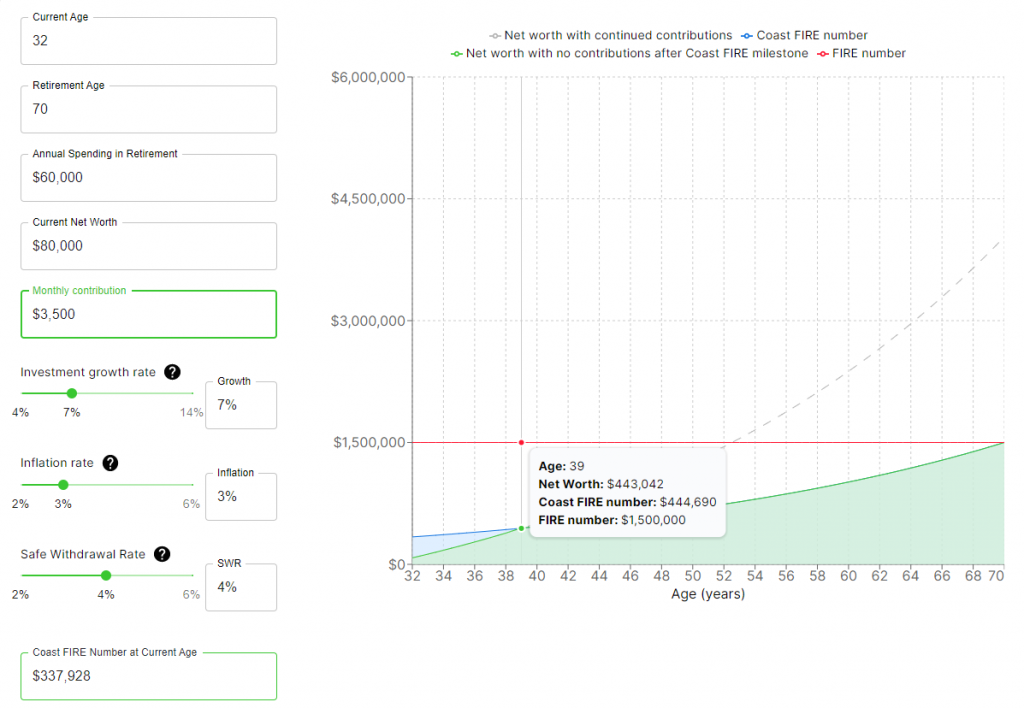

Coast FIRE Calculation

I don’t need to add that much extra to super over the next 8 years to coast financially in retirement. The coast calculator indicates I need to add $3500 a month to hit my coast target by 39.

To get to 60K annual income in retirement, this calculator indicates that I’d need $340K to coast to retirement. If I change that to 52K I’d need just under 300K.

Note: FIRE calculators often assume not eating into your capital in retirement hence why it recommends saving 3.5K a month, however I think above the age of 65 it’s fine to draw down more than the investment return if the money is likely to out live you.

So as long as I saved anywhere from 1.4K to 3.5K a month into super over 8 years, I should be pretty set? The 3.5K might be a stretch but maximizing concessional contributions for those sweet tax benefits is definitely the to way to go for me.

Summary

Coast FIRE is a lot more realistic than a full FIRE and might be more achievable for the average person out there who isn’t on a 6 figure salary. Is coast FIRE a reasonable financial goal for yourself?

How much income do you need in retirement? Read this blog post if you’d like to read a deep dive into more of this analyst.

1 comment