Financial Freedom , isn’t that the dream? This blog post is a reflection on the 7 step process I’ll be taking to secure my financial future. You can access my main spreadsheet here.

This is not personal financial advice and you should seek out a professional if you’d like to learn more.

Table of Contents

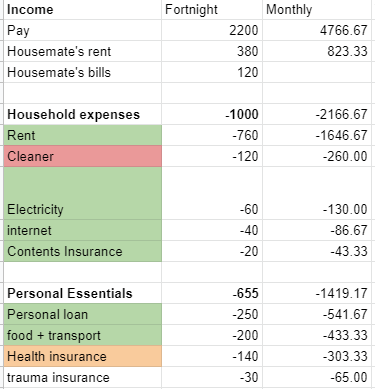

Step 1: Reduce budget

I quit my job in April, I thought I was going to be out of work for 3 to 6 months and reduced my budget to it’s bare minimum. I’ve since bumped up some of splurge spendings because I was only out of work for 2 weeks. But I’m choosing to keep this new budget to maximize my savings.

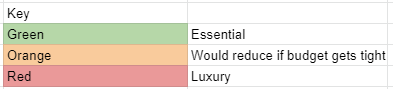

Step 2: Calculate monthly saving rate

I’ve calculated my comfortable monthly savings to be $3600. I’m going to round this down to 40K a year to give me a bit of extra wiggle room. I’m currently on a 850 per day contract rate but will have to pay GST, super and taxes out of that.

I’ve assumed 44 billable weeks in the year. I’ve subtracted 4 weeks for holidays, 2 weeks for sick leave and 2 weeks for public holidays.

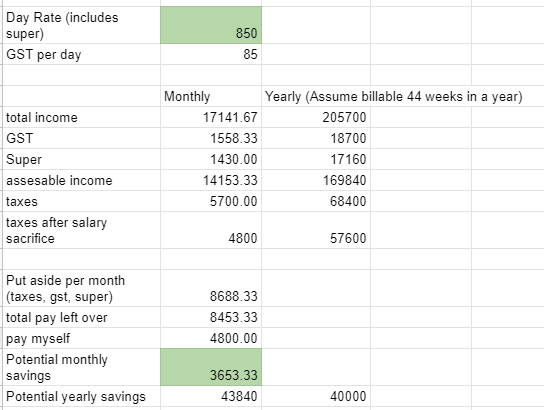

Step 3: Pay off personal loan

With that new saving rate in place, I can pay off my personal loan/credit card debt by September 2021. This will feel awesome to knock out. At it’s peak that credit card debt was 35K.

Step 4: Rebuild the emergency fund

Once the credit card debt is completely wiped out, I’ll be rebuilding an emergency fund. As someone working for myself now, I want this to be 6 months worth if expenses. 15K is the goal I’m setting myself to have in cash. This will take me 4 months to save.

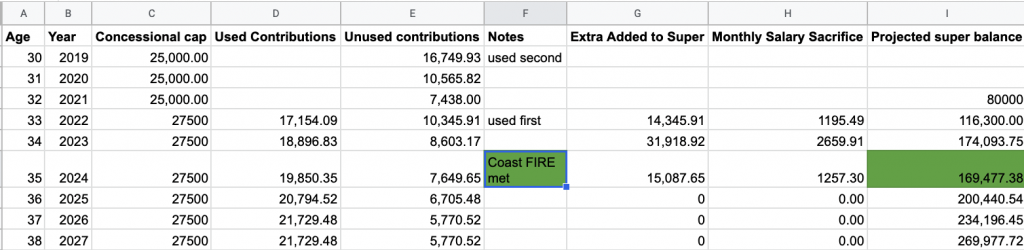

Step 5: Maximize carry forward concessional contributions

After that emergency fund is built up I’ll spend the next few years maximising my concessional contributions into super. This will allow me to coast financially in retirement.

Step 6: First Home Savers via Super

One benefit of maximising concessional contributions into super is I can withdraw up to 50K from the 2023 financial year. This is for my first home via the first home super savers scheme. Yesterday’s budget announced an increase to 50K for the FHSSS by July 2022.

I plan on saving an extra 100K outside of super to help buy a house. I haven’t budgeted for how much the mortgage will cost me yet because it’s still a few years away.

Step 7: Continue Saving

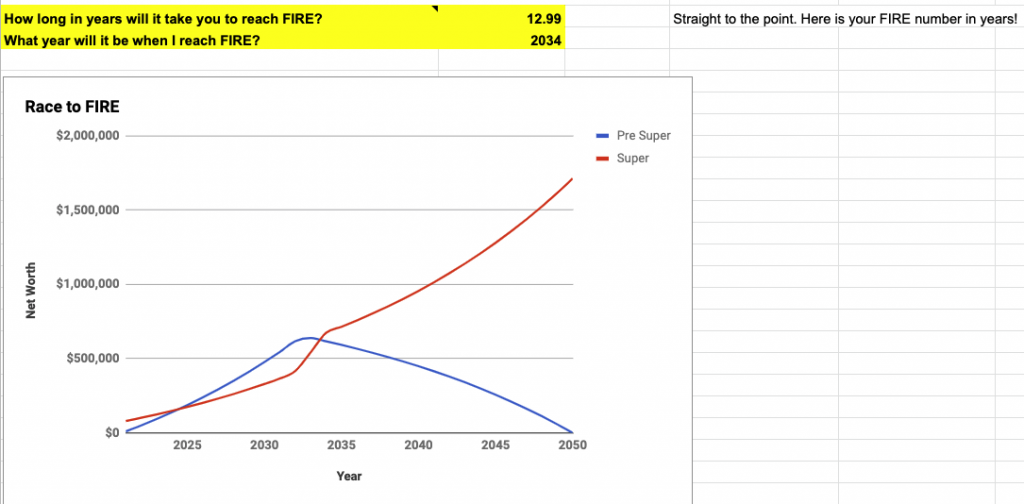

Using this Aussie FireBug calculator if I saved an extra 640K outside of super by the time I turn 47 I could full on retire early. I’d never have to work another day in my life. That 640K I could draw down until the age of 60 and then my superannuation will last me until my end of days.

I had never considered a full FIRE before this point, because I enjoy my current lifestyle too much to cut it down much further. But running the numbers and assuming what I’m earning is correct, I could actually earn enough for the ultimate financial freedom experience. Now that’s something to work towards.

What would financial freedom look like for you?

3 comments