I’ve gone through my budget with a fine tooth comb to help me answer the question, how long will my current savings last me? This blog post is a deep dive into that process.

I quit my job and I plan to work for myself for a few months. I would like to do this more long term but will still need to do some short term contracting while I build out my own business.

This is not personal financial advice, if you are concerned or have questions, a professional can help you sort your money out.

Table of Contents

Spreadsheets

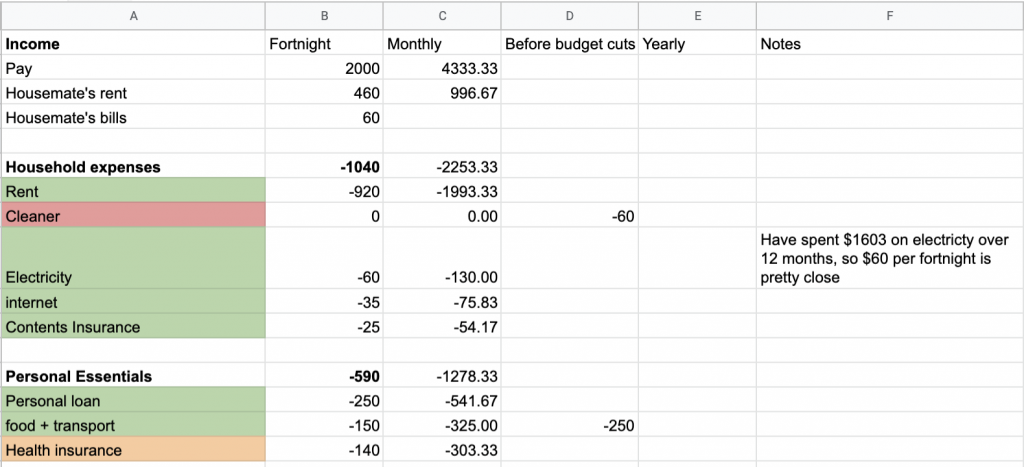

Back when I first blogged about my lifestyle plan, I used this spreadsheet to help track my budget. I’ve since refined it and removed all unnecessary budget items to come up with my new minimum budget.

Traffic light system

I’m using a traffic light system to measure if each item is essential, could be reduced or a luxury. For example I’ve cancelled my cleaner until the dust settles and I’m considering reducing my health insurance cover. However I’ve already reduced many other expenses to their minimum.

For example, I refinanced my personal loan to be over 3 years for a minimum fortnightly cost of $250.

Minimum Expenses

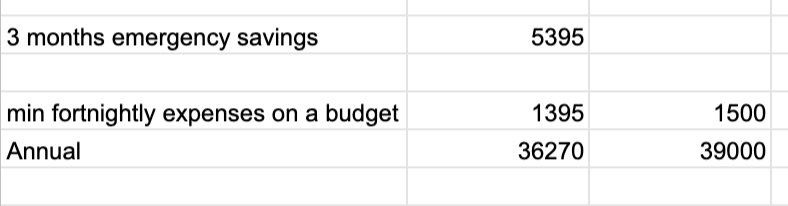

My minimum fortnightly expenses can be around $1400 to $1500. And 3 months of emergency savings would be less than 6k on a tight budget. So it looks like my 18K savings could last me 9 months before I have to go back into work.

Comfortable Expenses

I’d prefer to earn at least 2K a fortnight because this gives me some extra capacity to save for a holiday and pay down extra off my debt.

Testing out my new budget

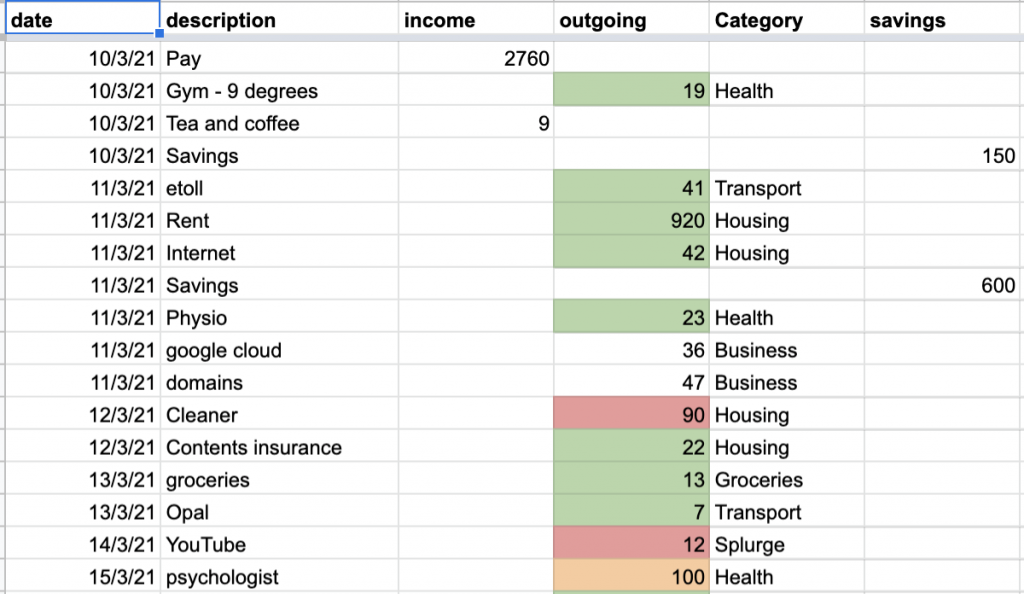

In the second tab of the new budget spreadsheet I’m noting down everything that goes in and out of my account. I’ll do this for the next month to see if my budget is actually realistic. My last day at work is the 5th of April. So I’ve got a bit of time to practice my new budget.

I’ll post an update blog post when I’ve let this budget run for a few weeks. Have you ever had to tighten your budget?

Brave decision, thank you for sharing.

Yes, been there and done that.

In my case, I wasn’t as well-prepared as you, but I came out of work with a redundancy payment which kept me afloat for about four months. The only big ticket item I bought with that package was a new suit. My priorities were:

1) Electricity

2) Broadband

(Both essential for looking for work)

3) Car (essential for getting to interviews: relying on public transport would have restricted me to a five-mile radius instead of the fifty miles I was considering. Even then, there were some potential employers who were within that five mile radius but which involved complex hour-long public transport journeys because of the way bus routes run hereabouts.)

Everything else came second, including rent. Fortunately, my landlady has a large portfolio of properties and was quite willing for me to take a rent holiday in return for a bit of DIY around the property and an undertaking to repay. In the end, I only ended up owing two months’ rent.

Thanks for your insights Rob. This is the first time in my working history that I actually have savings and I don’t need to rush into the next job. It feels nice to be in this place. My brain is still stressing over earning money but the act of going through my budget has mostly convinced it to quieten down just a little :).

When I move in mid April I’ll be upgrading to a decent internet plan because it’ll be more essential for me. With my last pay I plan on paying for 3 months of electricity too so it’s one less thing to worry about for a while.

$9 income for tea/coffee. Do you have a side business in coffee, you need to get more customers. 🙂 See you around Sam. ST

I’m running the tea and coffee for our student room at tafe. It’s definitely not making money. But it’s an experiment in advertising.