How much does it cost to be you?

This blog post is a walkthrough of how I manage my finances so I can answer the question, how much does it cost to be me? I’ll be doing a budget spreadsheet for the month of October to come up with a number for my minimum living standards and my current living standards.

This is not financial advice, if you are concerned or have questions, a professional can help you sort this out.

This is not a product recommendation, this a list of tools I use for my own personal finances

I own shares in CBA/Westpac/Tyro and have worked on some of these apps so please consider this a vested interest.

Table of Contents

Budget is an ugly term

I don’t like the word budget. gah, so ugly. So having a lifestyle or spending plan just sounds nicer. Glen James, who is a host on the my mellenial money podcast has his own spending plan program too.

I’m calling mine a “lifestyle budget”. I think it’s important to come up with a process that works for you. It doesn’t matter how many spreadsheets I’ve had professionals share with me, I’ve gotten more value out of tweaking my own method.

Create your own spreadsheet

There’s a plan

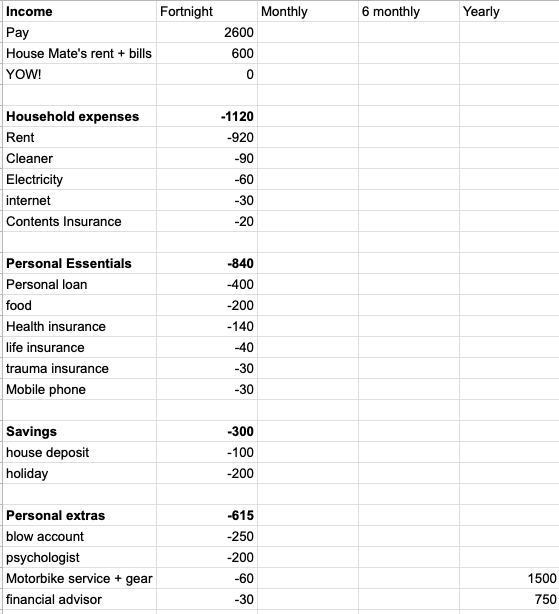

In the first tab I’ve listed out all of my expenses under a few categories, there’s the expenses I share with my house mate at the top. The total rent for the place I live in is $460 per week. I split the rent $250 for the big room and $210 for the small room. My house mate has the big room. We both contribute $50 a week towards house hold expenses.

I get paid fortnightly (every two weeks) and I’m in the process of increasing my salary sacrifice into super to save towards buying my first house using the first home savers scheme. You will see my October income is actually $2740, it’ll be $2600 from next pay.

Then there’s reality

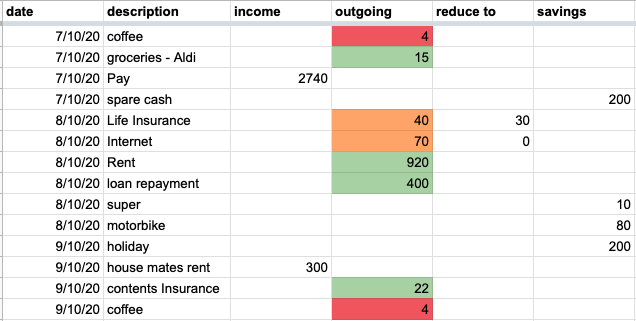

With the second tab I’m tracking my actual expenses to see if it matches with my plan. I don’t do this every month, I’m only doing this for October. I started on the 7th of October when I got paid and I’m tracking everything that comes in and out of my accounts:

Traffic light categories

I’m using a traffic light system to categorise each expense as

- essential

- Could reduce if my budget became really tight

- luxury expenses

If I lost my job, those luxury expenses would be the first thing to go.

When it comes to my minimum savings needed to survive 3-6 months I’ll be using my essentials + my reduced orange expenses to come up with a number.

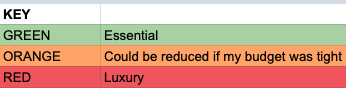

I fill in the spendings on mobile

I access this spreadsheet on my mobile device and fill it in as I go about my day, this is what it looks like on mobile:

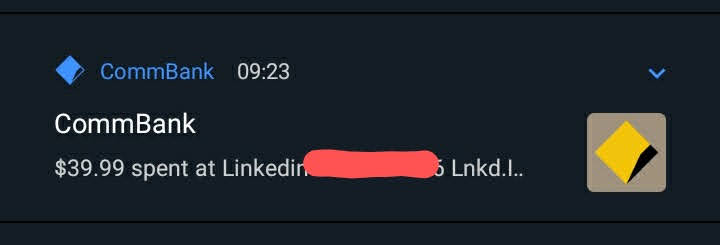

I like adding things in as soon as I see notifications for them:

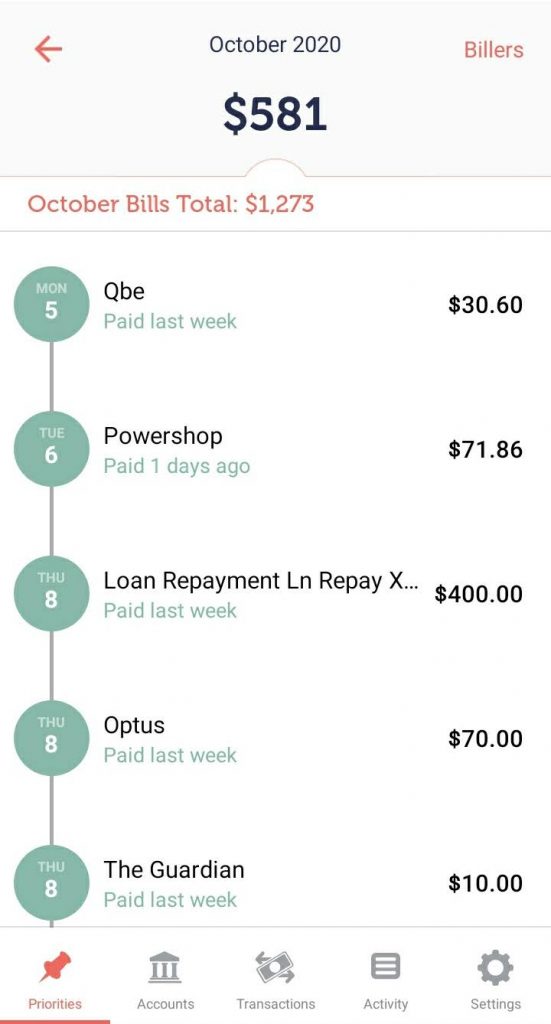

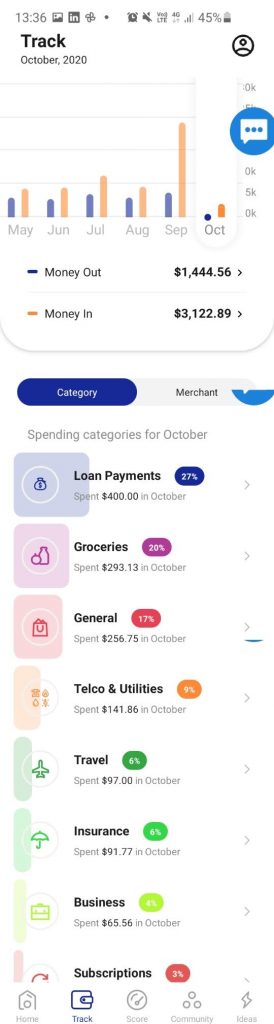

But I’ll also cross reference check with some of the budgeting apps like MoneyBrilliant to check they are keeping an accurate record:

I use seperate bank accounts as “buckets”

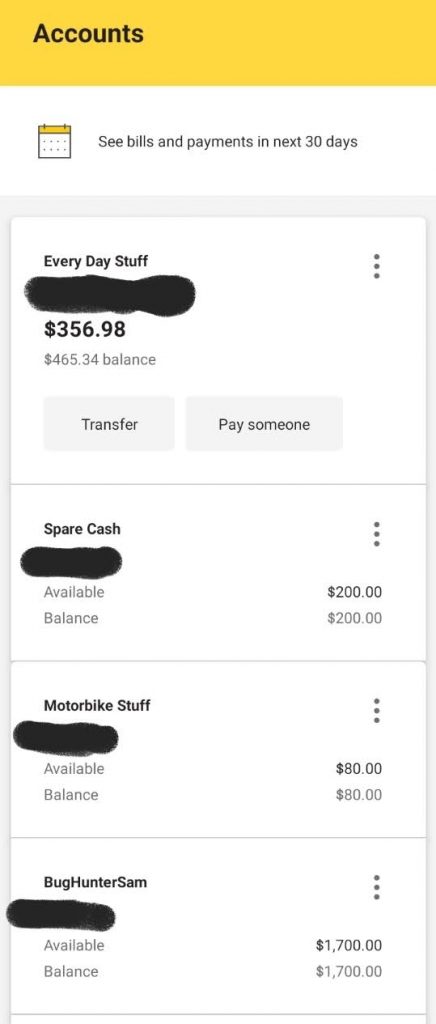

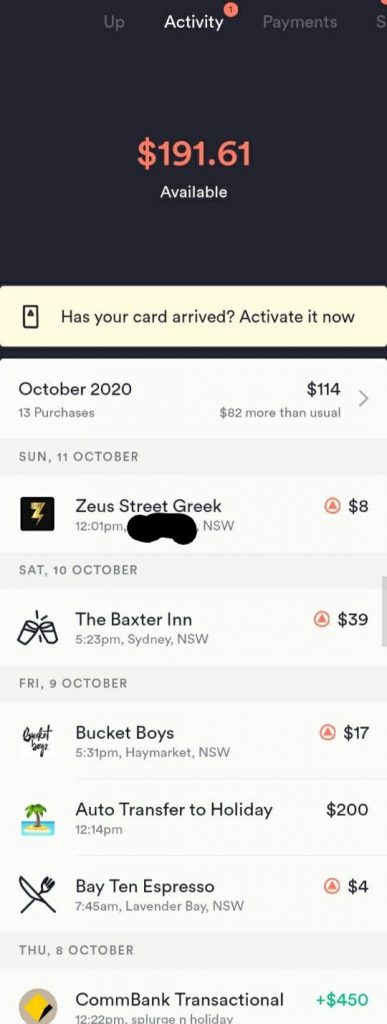

I have my groceries come out of my every day account and my luxury/Splurge expenses come out of my Up bank account which is connected to my phone via google pay.

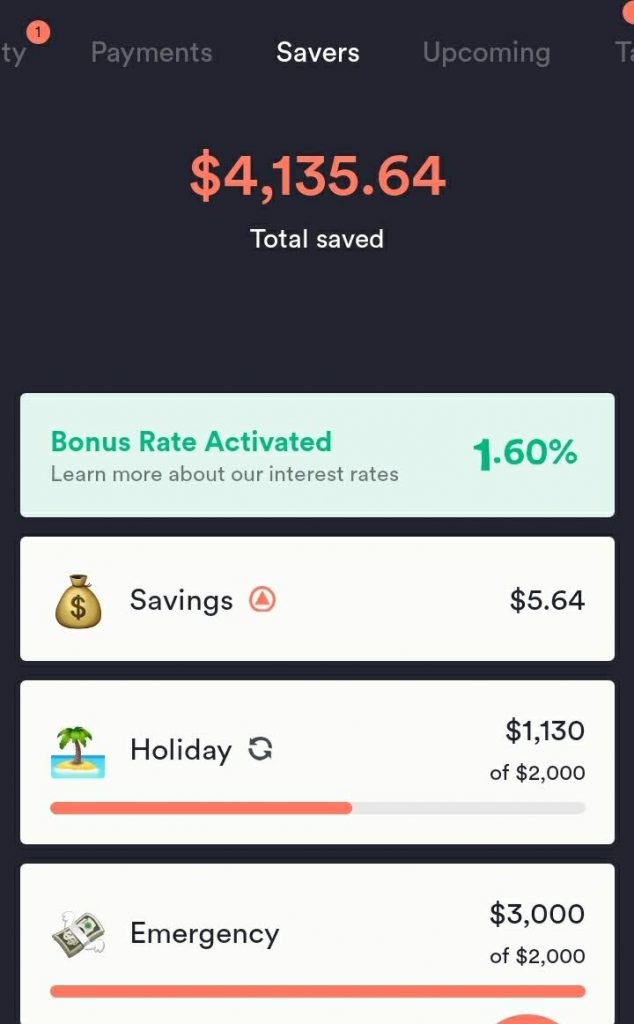

I also have a bucket for spare cash, emergency savings, business expenses and my motorbike expenses (I want to save up for a new helmet), this is very similar to the barefoot investors “buckets” process:

Upcoming bills

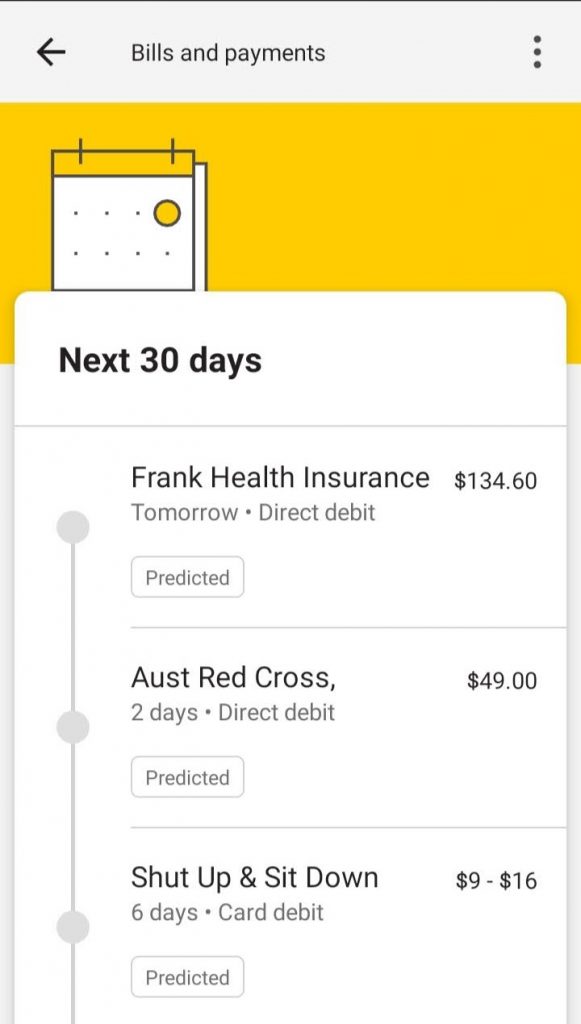

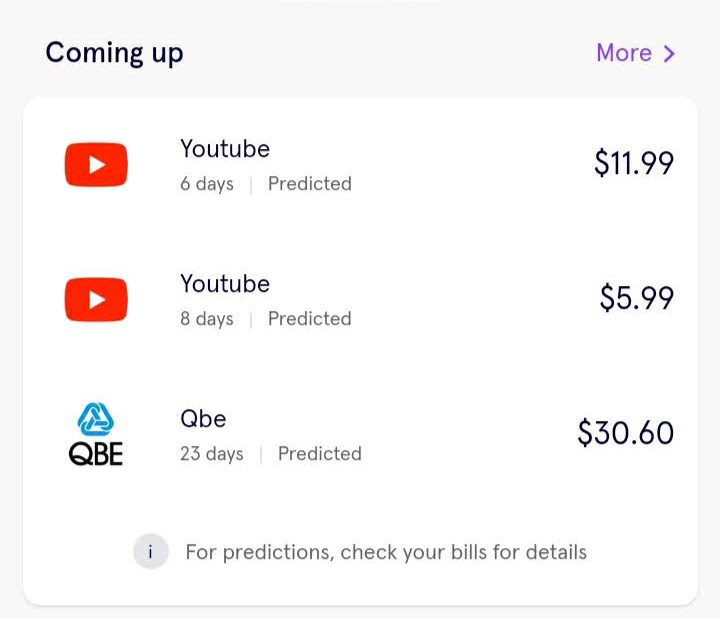

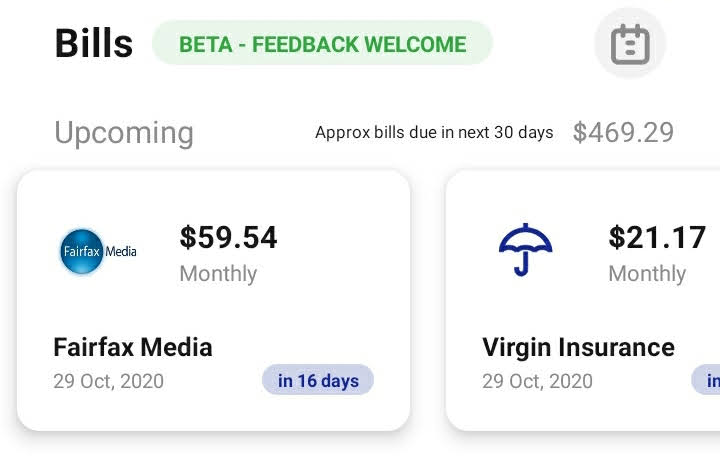

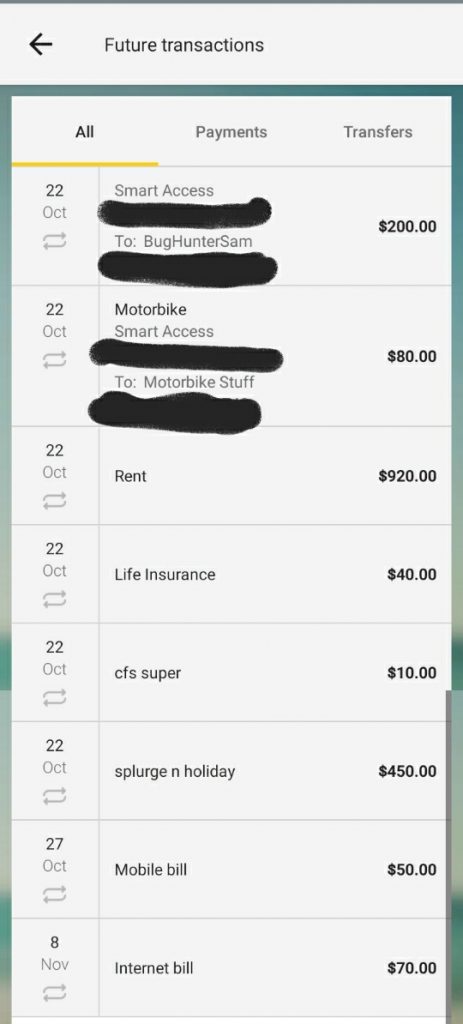

I also regulary check for upcoming bills through different apps (commbank, 86400 and WeMoney) to make sure I’ve got enough cash in my everday account to cover these costs:

Automatic Transfers

I try to set up automatic transfers as much as possible so I don’t have to think about my budgeting as much. I don’t have to worry about, “do I have enough money to pay for those bills due soon?”

Prepay bills

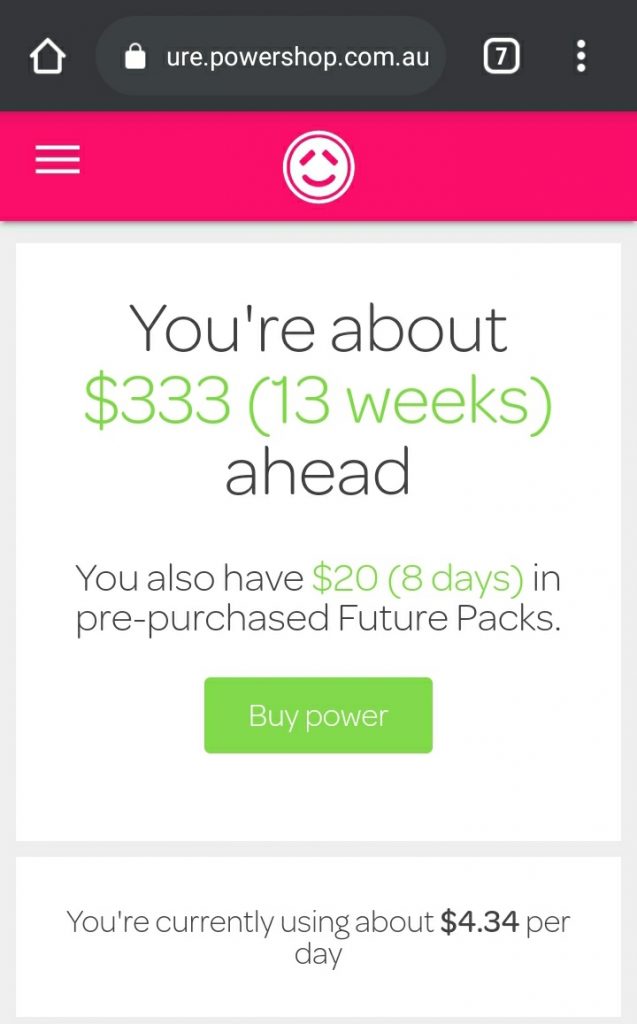

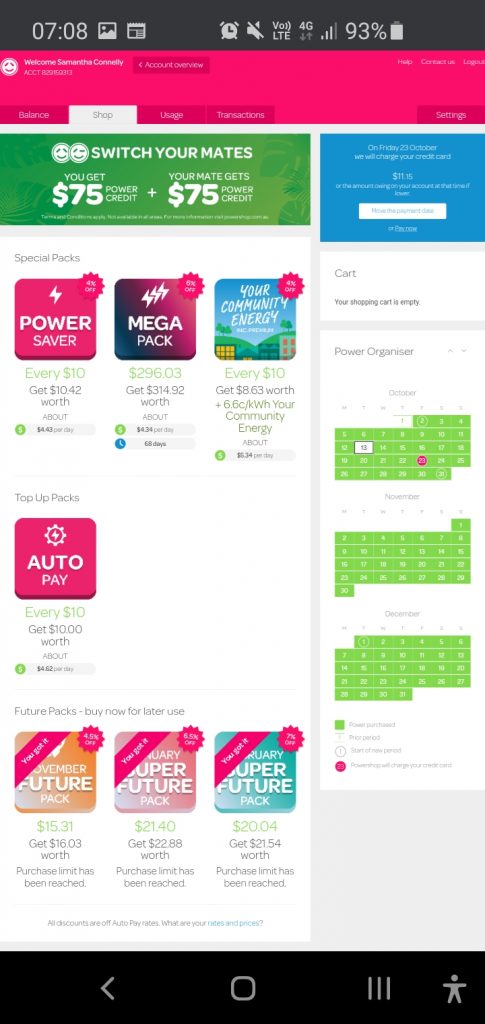

For my electricity, I like to be 3-6 months ahead. I’ve been stung by a few surprise bills before and hate being in that situation.

I also like to purchase carbon offsets for my electricity too. My electricity is through powershop and they have monthly future power packages that I always buy and a mega pack (2-3 months of electricity) that I’ll purchase every now and again.

Further reading

If you’d like to read more about my investment portfolio, my struggle with consumer debt or how my super is going I have a few more blogs you can check out.

At the end of the Month I’ll update this blog to see if my spendings actually matched my my plan. Stay tuned.

4 comments