Disclaimer; this is not financial advice. This is a story about how I put aside a small amount of money each pay and how I invested it into a portfolio. I also work/have worked for a few of the companies mentioned in this blog.

The TLDR; I put aside a percentage of my pay into investments/savings and topped it up when I got a bit of windfall.

Table of Contents

How this investing started

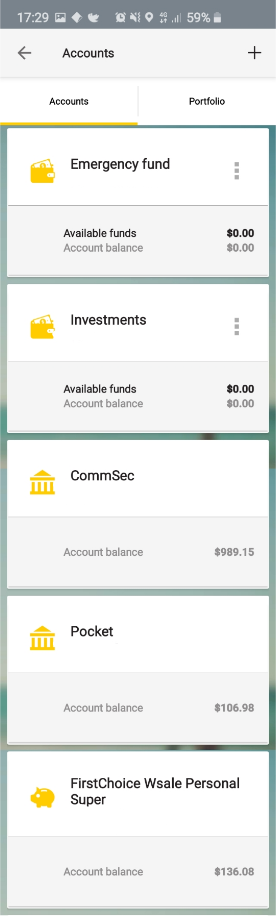

This all started when I got my 2018-2019 tax return. I wanted to learn how the stock market worked so I started with $1100 in shares. I started the year 2020 with no savings (I had just paid $1400 for a motorbike service) and only a small stock profile:

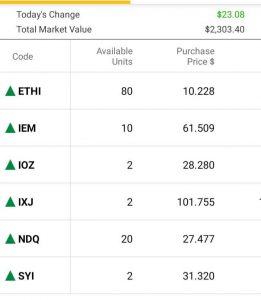

My initial portfolio was Westpac shares, prospa shares and 2 ETF’s (index funds):

Setting up regular payments

I get paid fortnightly (every two weeks) and back in January I tired to set up the following regular transfers:

- $100 per fortnight into super (a retirement savings account)

- $70 per fortnight into cash

- $60 per fortnight into shares

- $50 per fortnight into property

Which would be $7280 invested/saved over a 12 month period (which is over 10% of my take home pay). But the pandemic kicked in, my income from my side business dried up and I had to have my gall bladder removed (which was a 2k out of pocket emergency expense). I ended up doing:

- Salary sacrificing into super to take my contributions up to 15%

- $100 per month into property

The technology I use

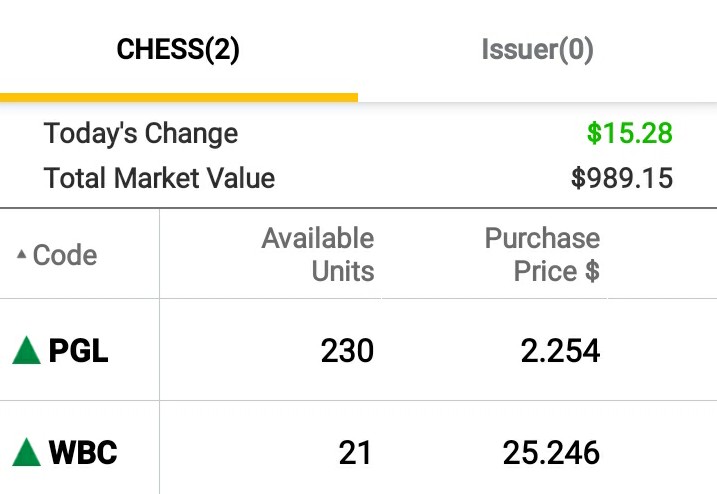

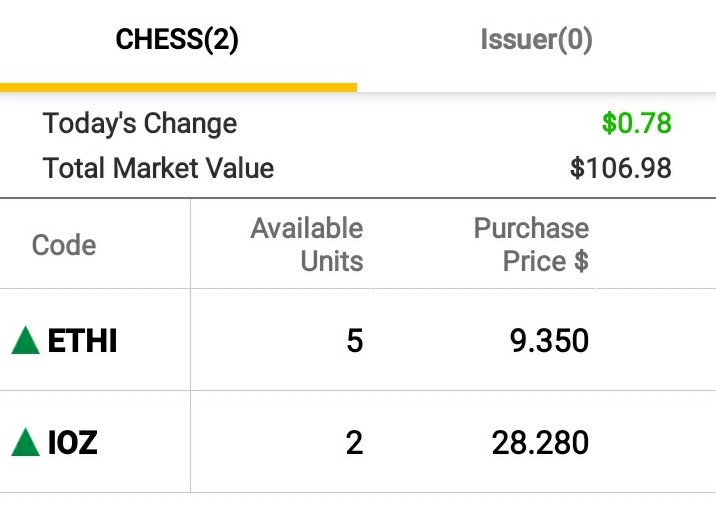

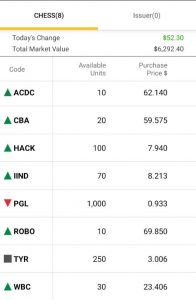

For investing in shares, I’m using Commbank’s pocket app to invest in different ETF’s and using their commsec app to buy shares when I have a bit more money. The minimum investment in the pocket app is $50 and the minimum investment in commsec is $500.

For Property, I’m using brickX, which is a company that buys properties and then divides each property into 10,000 “bricks”, they then on sell each brick to budding property investors. Their minimum investment is $50 a month for their self managed “smart plan”.

When I get a bit of a windfall (e.g my tax return or bonus) I’ll squirrel away a bit of extra into my portfolio to help balance it out.

Here’s what that portfolio now looks like after 12 months:

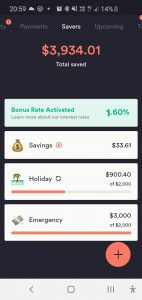

- There’s 3k in emergency savings

- 2k in property

- 8k in stocks

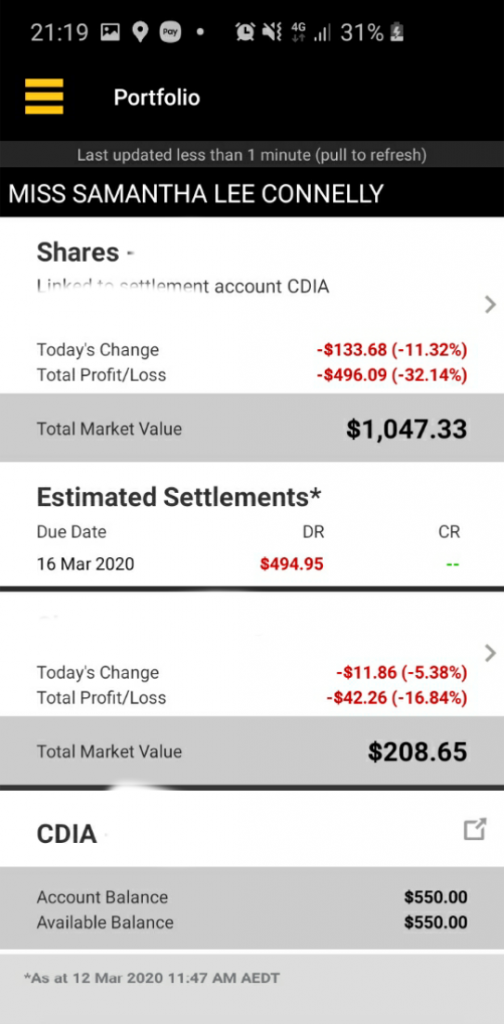

Shares (some are still poorly performing):

Property via BrickX:

Emergency savings via Up Bank:

Side note: During the peak of the Pandemic 😱

I was down nearly 30% at one point during the pandemic and it got worse, you can check out my investing during a crisis blog if you’d like to read more.

Also there are tons of investment platforms out, here is an interesting video comparing the fees on the different platforms:

2 comments