This is not financial advice, this a story about my adventures in learning about investments and stock markets.

So when I got my tax return last year, I decided to learn how the stock market worked by investing $1000 in shares.

note; this is generally considered a bad thing for me to do financially because I have some credit card debt that I’m paying off and I should put spare money towards that first. You can read more about my debt here.

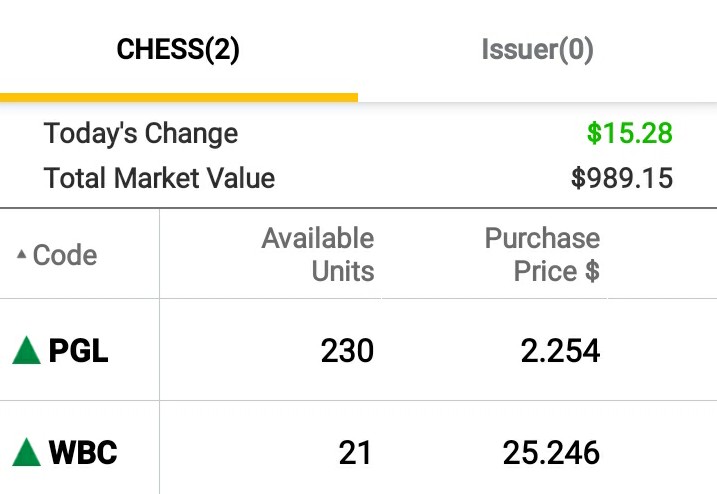

However, I wanted to learn so I thought it was worth putting aside the money into stocks instead of paying off debts. I Bought $500 worth of Westpac shares (they’re share price had just dropped because of the money laundering scandal) and $500 worth of prospa shares because they had just had a drop after a market re-evaluation. I had bought them around $25.25 and 2.25 per share respectively.

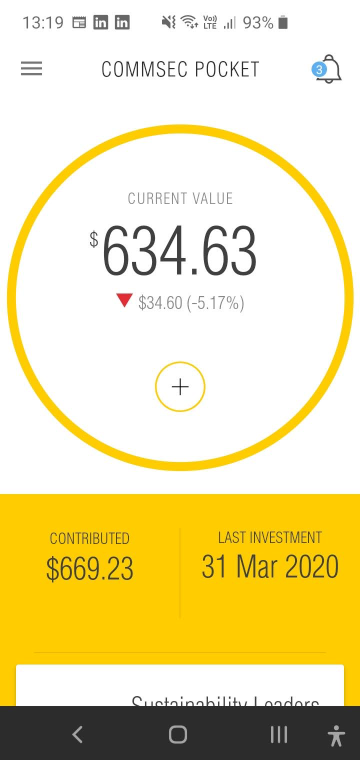

I also purchased a few ETF’s via Commsec Pocket (around $250 worth). I’m using both CommSec and CommSec Pocket which have a minimum investment of $500 and $50 respectively to learn about investments and stock markets.

Table of Contents

Then came the market crash

All of a sudden, those shares I had bought dropped by nearly 40% in value. Instead of selling out, I bought more shares. I found out that a market crash is often called a bear market. Bear markets can often happen before a recession.

This video offers a good explainer of how investing during a bear market can help even out losses:

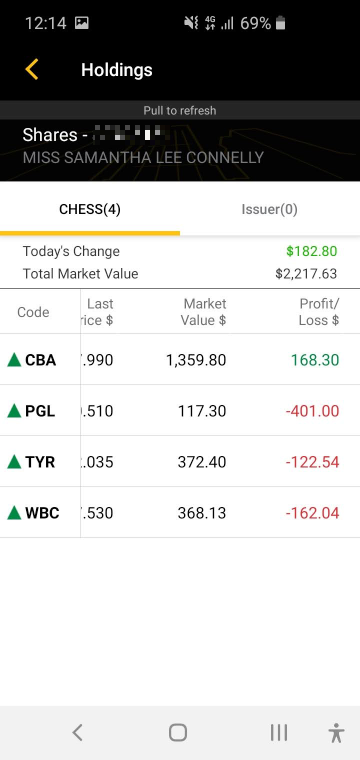

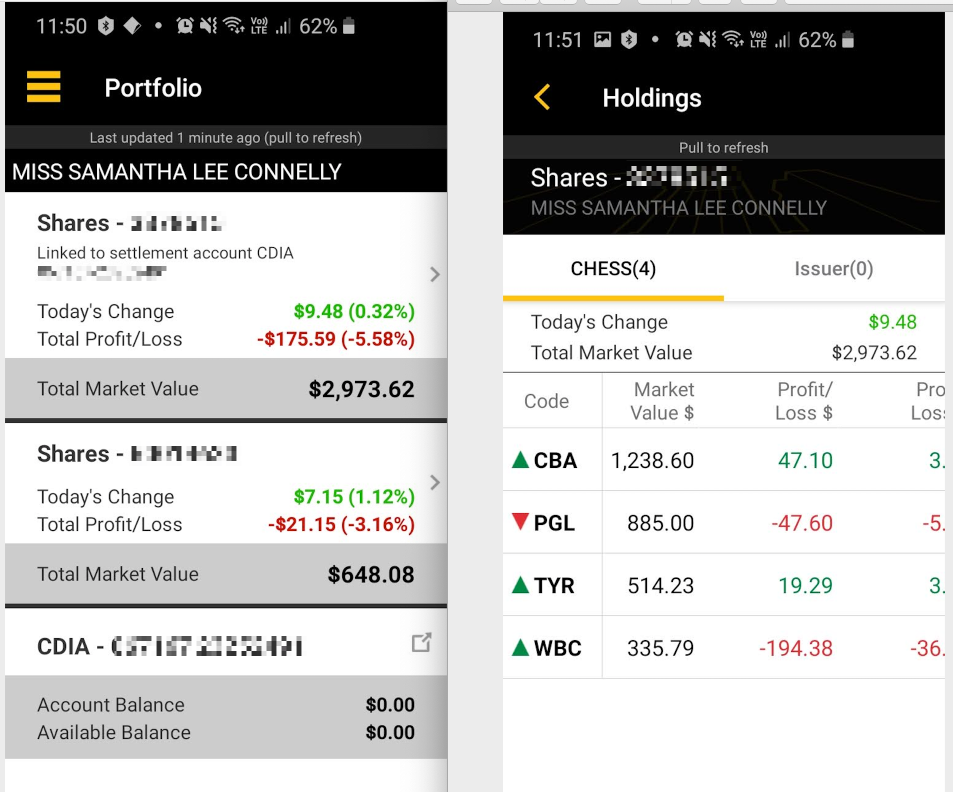

I had wanted to buy some Tyro shares (I previously had worked for Tyro and they had a recent successful ASX launch). I bought $500 worth of Tyro shares at a price of $2.7 a share around the 13th of March.

However, the market still had more crashing to do. The Tyro share price bottomed out at 0.97 a share on the 19th of March. If only I had waited a few more days. I could have bought a two to three times more shares for my $500 worth. Oh well. In times of high volatility it’s really hard to know what’s going to happen.

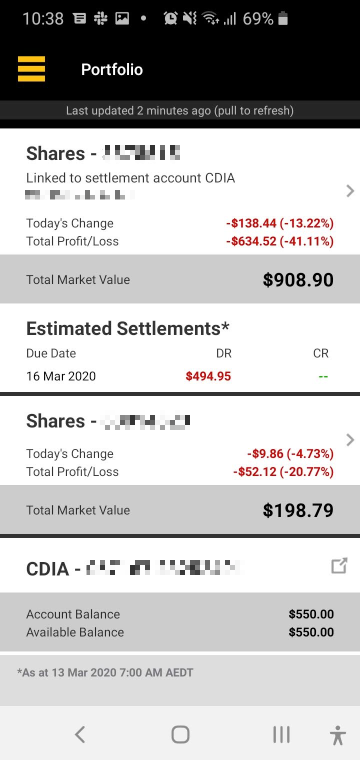

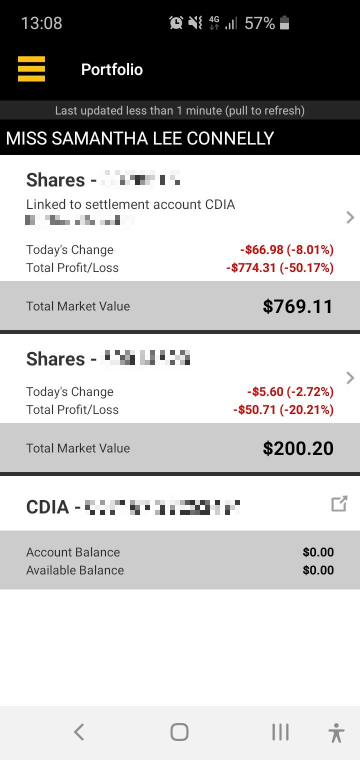

Well shit, this now felt like pissing $ against the wall. I had lost 50% in value and this felt terrible. Even my ETF’s had lost 20%.

Buying MORE shares

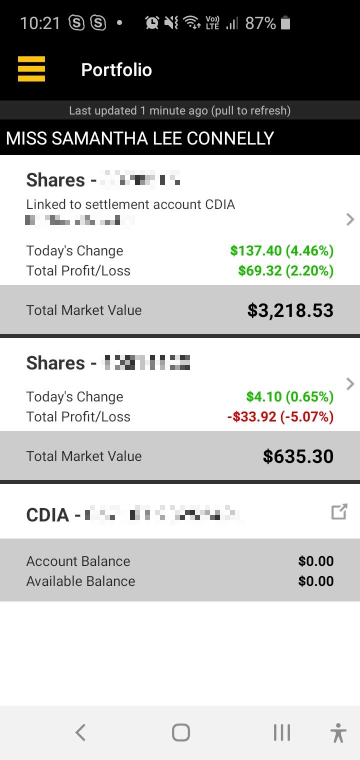

After the dust had settled a little. I bought $500 worth of CBA shares (I work for commbank) and my mum gave my an extra $500 for some CBA shares too (we paid roughly $60 per share). And they had increased quite quickly after that point.

Oh gees, look at those losses on those Prospa shares, -$400 yikes…

Evening out losses

I noticed the Prospa share price had fallen down to about 0.50 cents per share, I had just gotten paid and I decided to even out my losses. I increased my 230 shares to 1000 shares.

I reason I might as well buy a few more Prospa shares while they are cheap, I reckon that eventually small businesses will need loans again soon.

I had also purchased a few more EFT’s. I had now invested nearly $670 in EFT’s.

This was a few days before the government had announced a stimulus package to help companies like Prospa lend more money to small businesses. Prospa shares skyrocketed to $1.05 per share. All of a sudden, my biggest loss was holding up my entire portfolio and my portfolio now actually had a positive value of 2.2% .

Woohoo. That’s the first time I’ve seen green on my portfolio in a long time.

There’s been a few ups and downs

My portfolio has still gone a bit up and down since then. Today I’m still at a loss of 5.58%, Those PGL shares are still at a small loss but it’s no where near that -$400 value. Those westpac shares are now my biggest loss. I might even them out in a few weeks but I’m no rush to do so.

But oh boy, have I learnt a thing or two about stock markets since I started investing 6 months ago. I think it was money well invested based on that outcome alone.

Have you had any hard financial lessons learned from this crisis? You might also enjoy reading this blog post on how the coronavirus has impacted my superannuation.

The views expressed in this blog post are mine alone and do not reflect my employers views.

3 comments