How much money do I need to save for an emergency? That’s a good question. The barefoot investor recommends starting with a 2k emergency savings. Then building it out to 3-6 months worth of living expenses once debts have been sorted.

This is NOT financial advice, a professional can help you if you have any concerns about your finances.

Table of Contents

Figuring out my living expenses

I’ve spent the last month tracking my lifestyle expenses and you can access the final version of my spreadsheet here. My emergency savings is for the situation “I’ve lost my job” and need to survive off my own steam.

I’d like to aim for 3 months worth of savings and building that up to 6 months before I start my own business full time.

Categorising the budget

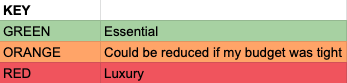

I used a green, orange, red category system to figure out my lifestyle costs over the month.

- Green = Essential

- Orange = Could reduce

- Red = Luxury

I can then count up all of the categories and say things like:

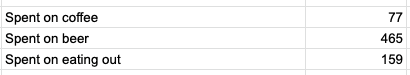

- In the last month I spent $80 on coffee

- I spent on average $110 per week on beer

Minimum living expenses

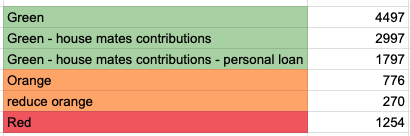

My minimum expenses would be the total of the green amount, minus my housemates contributions + my reduced orange expenses.

I have another minimum value that is subtracting my personal loan repayments because I’m on track to having that paid off in 2 years time.

But I might be paying off a mortgage for some land in Tasmania around that time so I don’t know if I should include it or not. Hence why there’s two levels.

My basic living expenses is a threshold between $6,300 and $11,340 for 3 months.

6 months emergency savings goal

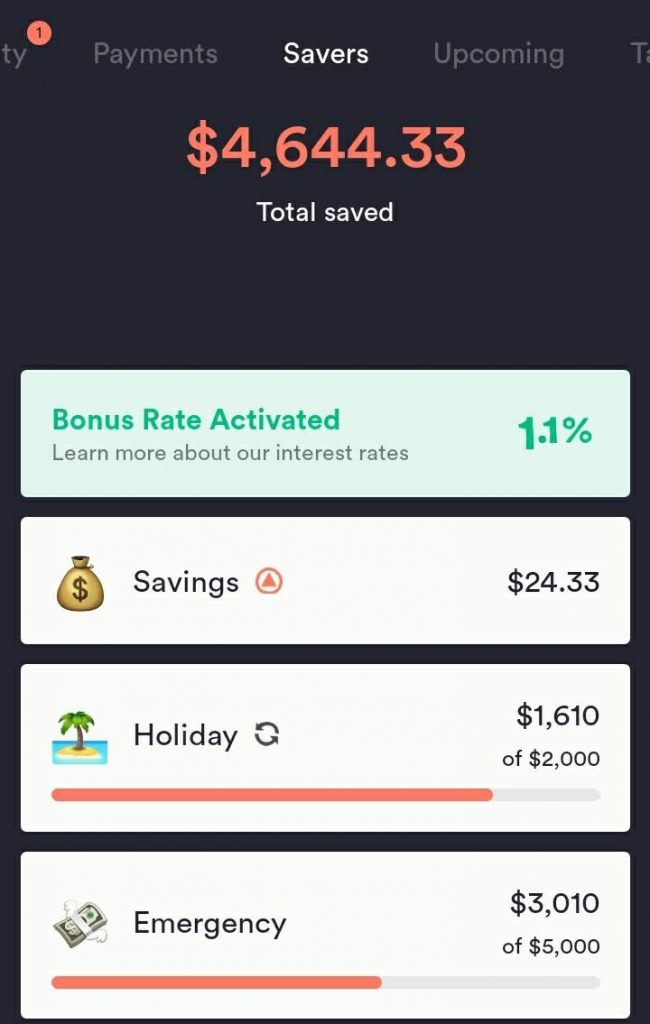

I’d like to have 20k to 25K saved up as an emergency fund before I start my own business full time. I believe 6 months worth of living expenses will give me enough of a safety net to take that risk. I’m currently at 3k in my emergency savings:

Saving for a home deposit

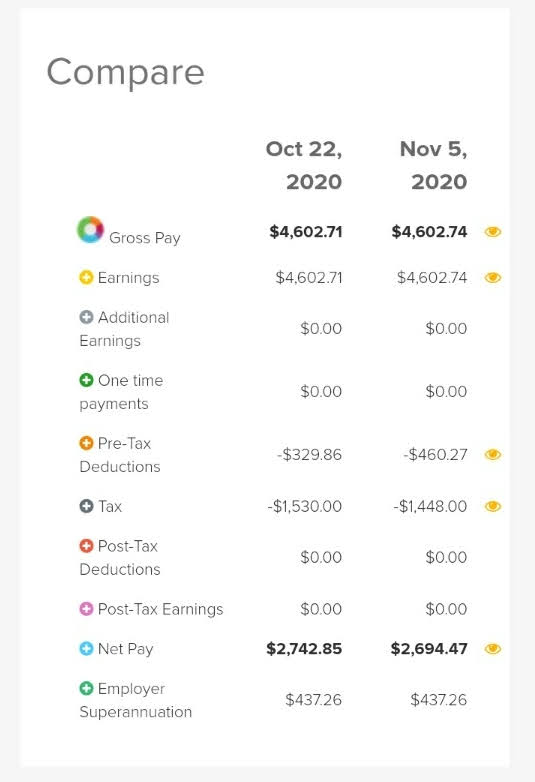

I’m also saving for a deposit on a house. I’ve just increased my salary sacrifice into my super to $460 per fortnight and I plan on using the first home savers scheme in a few years time.

I’m now close to maximising my contributions into super and approaching that 25K concessional contributions limit over the finiancial year.

If you’d like to read more, I have these related finance posts:

But these savings goals are going to take me a bit of time to build up. What are you currently saving for?

1 comment