I’ve gotten 3 windfalls of cash recently;

- my tax return (1.5K)

- my bonus from work (5k after taxes)

- 10k from super/retirement fund

this post is a reflection on what I’ve done with that money. All numbers are in AUD.

This is not financial advice, a professional can help you figure out the best approach for you.

Table of Contents

Show me the money

I first withdrew 10k from my super, then my bonus was 5k after tax and then my tax return was 1.5k. For a total of 16.5K in extra cash in the last 2 months.

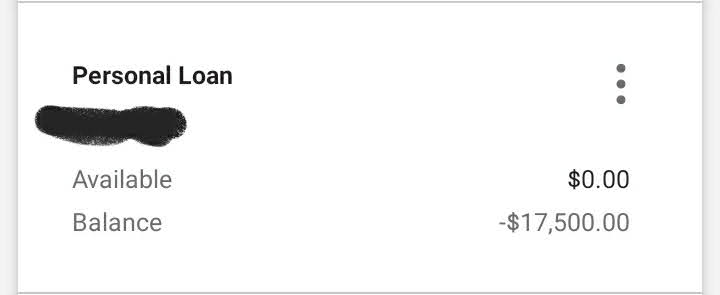

Paid off debt

The first thing I did was pay off a 2k credit card, cleaned up my outstanding zip-pay and contributed and extra 1k towards my personal loan.

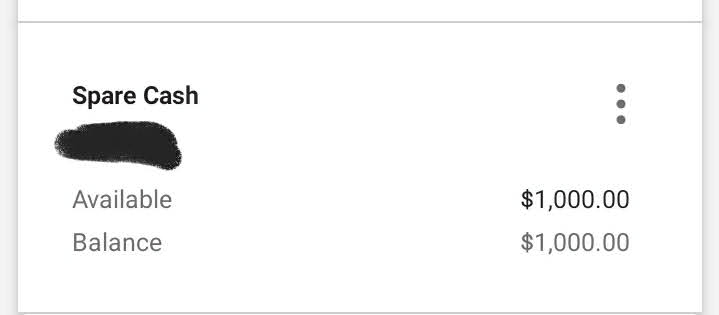

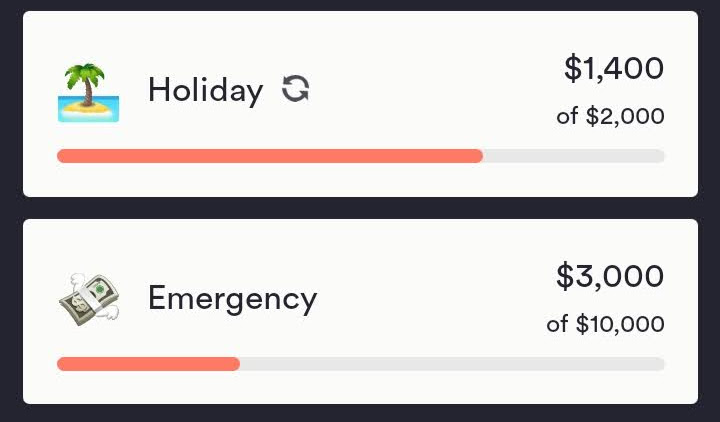

Emergency Savings

The next thing I did was put 2k into an emergency savings account. Then topped it up with 1K one month later when I got my bonus. Then I put 1k into a spare cash fund in my main bank when I got my tax return.

Holiday savings

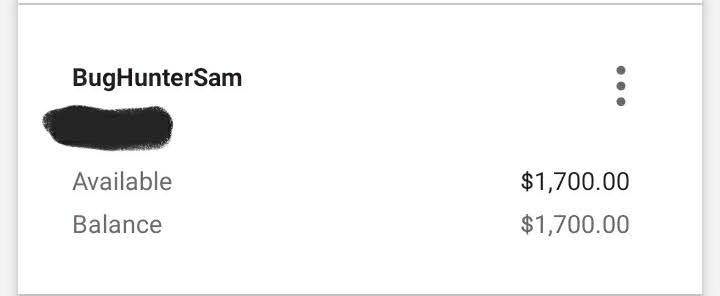

I put 1k towards the purpose of saving for a holiday and 1.5k towards my side business app idea.

Investing in the stock market

This is not a product recommendation, this a list of funds that I invested in for my own personal investments

I bought mostly index funds (an investment with a selection of companies):

- 10 units of the ACDC (battery storage companies)

- 100 units of the HACK (cyber security companies)

- 70 units of IIND (top companies in India)

- 10 units of ROBO (global robotics companies)

- 18 units of NDQ (tech companies)

- 8 units of IEM (mostly Asia and other emerging markets)

- 43 units of ETHI (an ethical/sustainable investments fund)

- 2000 units of DOU (a new neo bank for the US market)

Which is nearly 4.2k invested, that DOU investment is an experiment, most of my portfolio is index funds and not direct shares.

I use Commsec and Commsec Pocket to buy shares. This is not a product recommendation, all major banks in Australia have some sort of trading platform and there are alternatives like Stockspot, Raiz and Spaceship. Your superannuation is also an investment account.

Investing in property

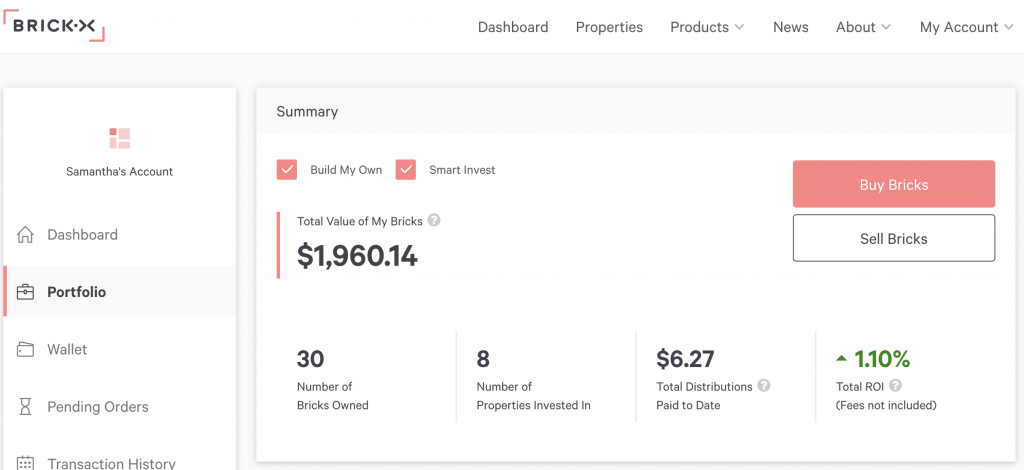

I put 1k into brickX, I’m doing this to learn about property investment over time with small investments.

This is not a product recommendation

Treat for myself

I took my partner out for dinner for their birthday, we went to Tetsuya’s; a Japanese fine dining restaurant in Sydney. I prepaid for the food and paid for a whiskey at the Baxter Inn before hand. This was a $500 treat and I also spent $200 on buying some new clothes.

Feeling financially stable

This is the first time ever in my adult life that I’ve felt financially stable. It is an awesome feeling. I can’t state how grateful I am for escaping the poverty trap and not getting stuck in the over spending loop. In our society it is too easy to overspend.

I’ve previously written about how I manage my budget, my struggle with consumer debt and how my super is going too.

Any future windfalls will probably go towards my personal loan and then towards my emergency savings.

Congratulations that your hard work and prudent choices are bearing fruit

Is Betashares a good platform for index funds

vanguard is considered the biggest one, they are all pretty similar but have slightly different investment strategies. Stockspot has an interesting comparison for global ETF’s here: https://blog.stockspot.com.au/best-global-share-etfs/