This is not financial advice, this blog is a reflection on how unit prices and stock markets impact superannuation (Australian retirement funds), all prices listed are in AUD.

At the end of last week I rolled over my superannuation from Verve to Sunsuper because I wanted more flexibility over my investment allocations. Verve had 1 balanced investment option and Sunsuper has a few more to choose from. My super money was “in transit” for 3 days while the markets crashed around the world. My back of the envelope calculations show my super balance to be $2300 better off and this blog I’m going to walk through that maths with you.

Table of Contents

Closing Balance

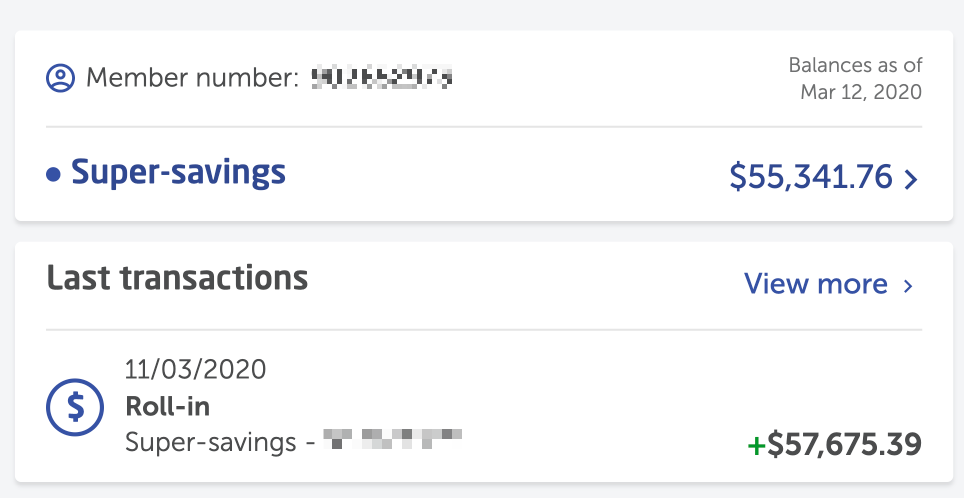

When I rolled over from Verve my super balance was around $57K. It was at $60K a few weeks ago before the market started to take a nose dive. Verve calculated my closing balance as of Friday the 6th of March. Sunsuper processed my rollover transaction on Wednesday the 11th of March. My super balance is now valued at $55K as of Thursday the 12th of March.

Unit prices

Each investment option in superannuation generally uses a unit price to track investment growth. If the current unit price is $2 and I invest $100, I have just bought 50 units (100 / 2). If the market improves and that unit price increase to $2.20 my investment is now worth $110 (50 * 2.2) and my investment has grown 10 percent (((2.20 – 2) / 2) * 100). Unit prices are usually calculated at the end of every business day and are reflected on your super balance 1-2 business days after stock markets change.

Two Investment Options

I have my investment with Sunsuper split over 2 investment options, 80% growth and 20% socially conscious balanced. I have ~13,800 units in growth and ~3,800 units in balanced.

Unit Prices over time

The growth unit prices have gone from 3.4963 on Friday to 3.20653 on Wednesday. A downturn of 8.3%.

The balanced unit prices have gone from 3.15565 on Friday to 2.91942 on Wednesday. A downturn of 7.5%.

My super is now $2.3K better off

If I had invested $57K on the Friday instead of the Wednesday I would have bought ~13,200 Growth Units and ~3,700 Balanced Units respectively. By Thursday the 12th of March that would have come out to a balance of $53K (1*). That’s a difference of $2,300 compared to my actual balance (2*).

1* ((13196.2864 * 3.20653) + (3655.20384 * 2.91942))

2* (55341.77 – 52985.36)

Caveats- market downturns aren’t bad

There’s nothing inherently bad with markets taking a downturn, this is what markets do. Expecting the economy to always grow infinitely isn’t exactly what happens. Also this money doesn’t mean anything until it’s used/exchanged. Right now all of these stock prices and values are ones and zeros in a computer somewhere.

I have a test account with Colonial First State that I use for checking our software in production. I have this one asset allocation that achieve nearly 6% returns since it’s inception and that includes the global financial crisis of 2008:

* I work for Colonial First State

Super is a long term investment

I’m not concerned with this market down turn. I consider my retirement fund to be imaginary until I actually get to use it. And who knows what will happen between now and then? This has been as fun exercise in understanding unit prices. If you’d like to read more about my financial situation, I have this blog post on turning 30.

How has the Coronavirus outbreak impacted your investments?

4 comments