I’m studying to be a financial advisor and I’ve been exploring many of the mobile apps out there that can be used to help manage finances. This post is a review of the ones I’ve used so far. My preferred apps are listed first.

This is NOT financial advice or a product recommendation, a professional can help you if you have any concerns about your finances.

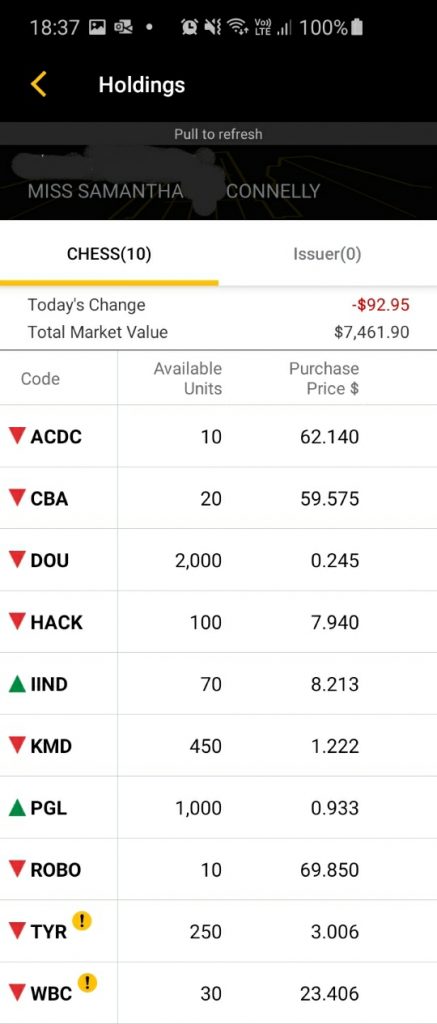

I own shares in CBA, Westpac, Eggy & Tyro. This represents a vested interest.

Table of Contents

Table of contents

Budgeting Apps

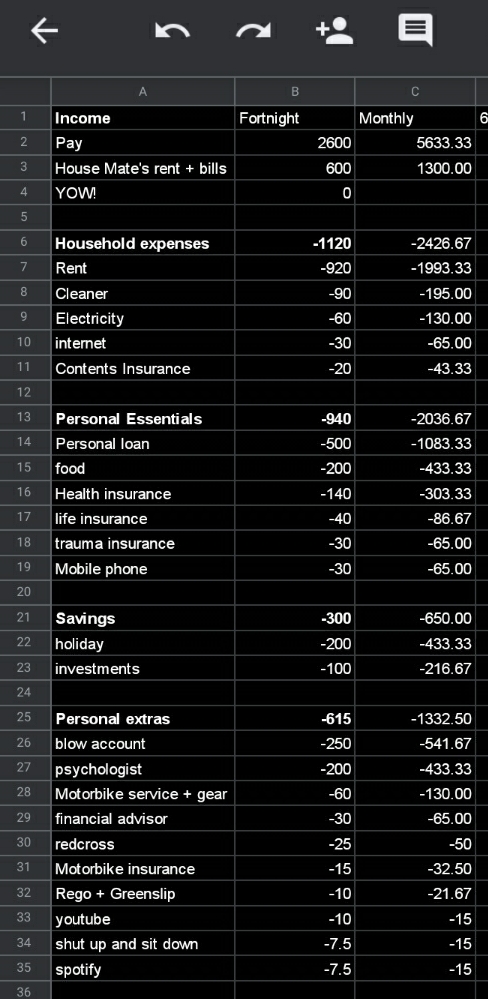

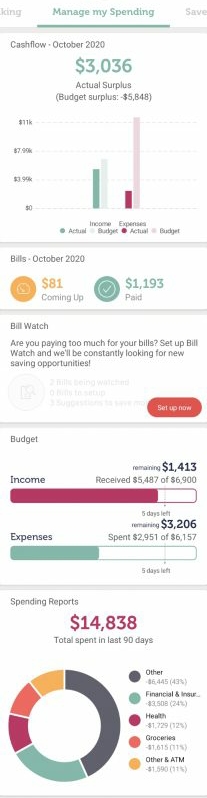

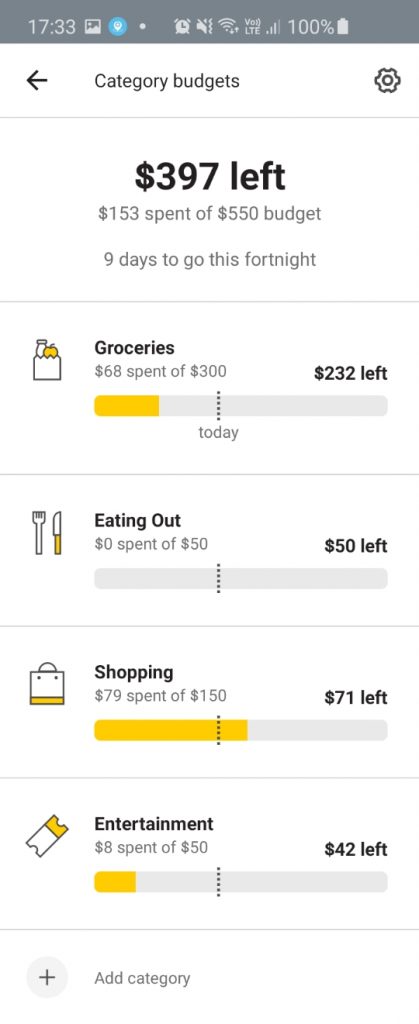

I prefer using a simple Google sheet to manage my budget, however money brilliant looks pretty and Up bank has a cute little budget tool built into it too.

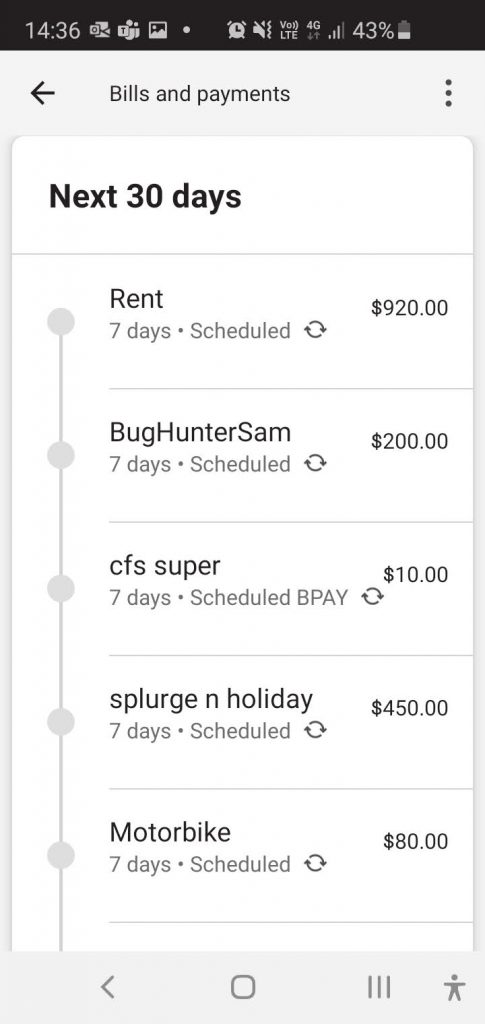

Commbank gets in honourable mention because their upcoming bills feature has helped me keep on top of expenses due to come out of my bank in the next few days.

Many of these apps have a bank feed import feature and they can miss label transactions/categories and it can be frustrating to fix.

You can read more about how I manage my budget here.

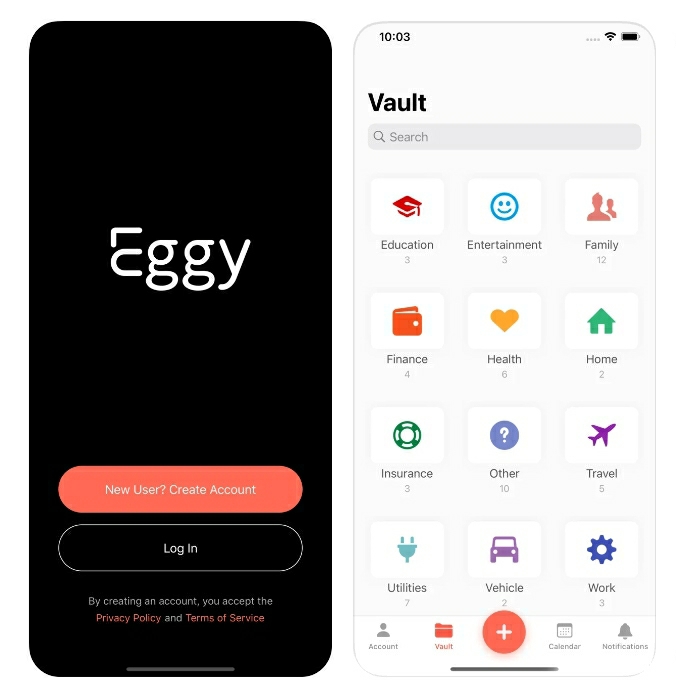

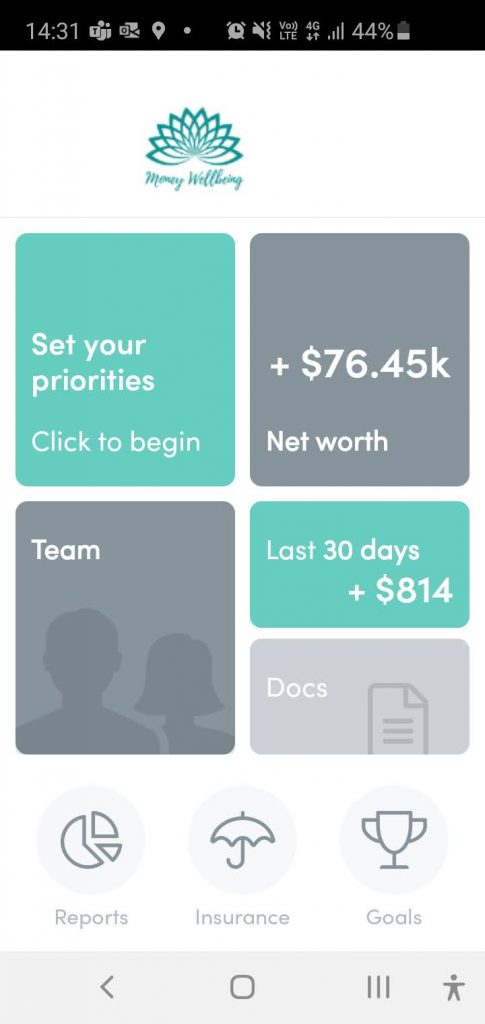

Life Admin Apps

These apps aren’t strictly budget related but can help you with your budget through helping with life admin. With reminders for upcoming bills and connecting with financial advisors.

I own shares in Eggy via Birchal.

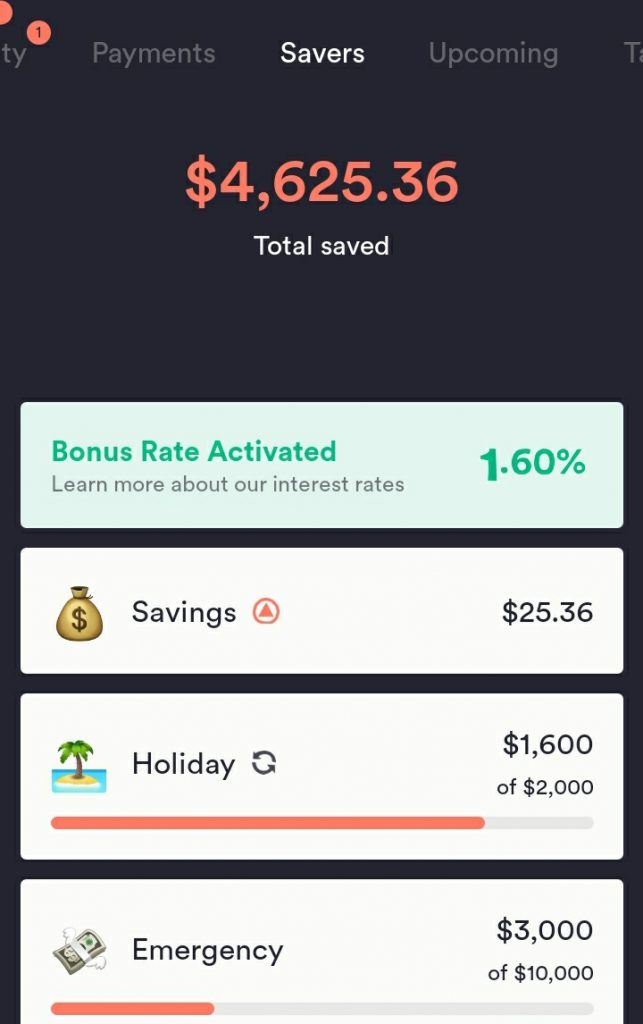

Banking Apps

I love Up Banks branding and personality. They also have an ok interest based savings account and an auto round up saving feature on transactions. Westpac has a 3% interest for anyone under 30.

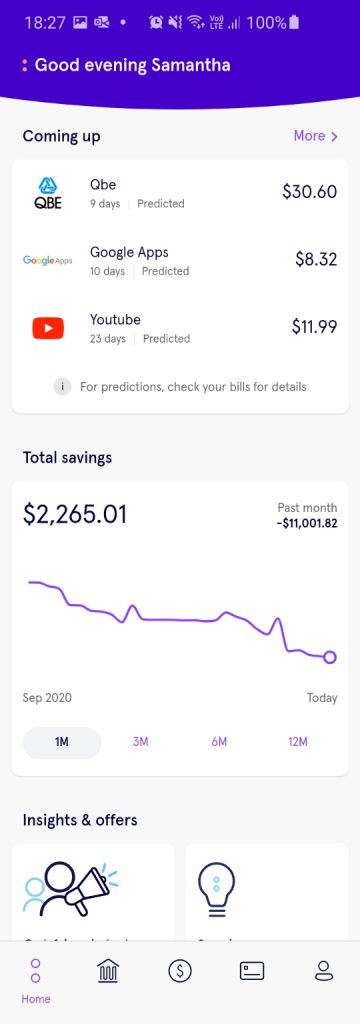

Otherwise most of my banking is done through CommBank. I have used a variety of other banking apps but they are all kinda similar. 86 400 has a bank feed integration feature and a decent predictive bills feature which is cool.

The bank card I received from Xinja was the funnest card that I received:

Business Banking

- Tyro

- Commbank

- Westpac

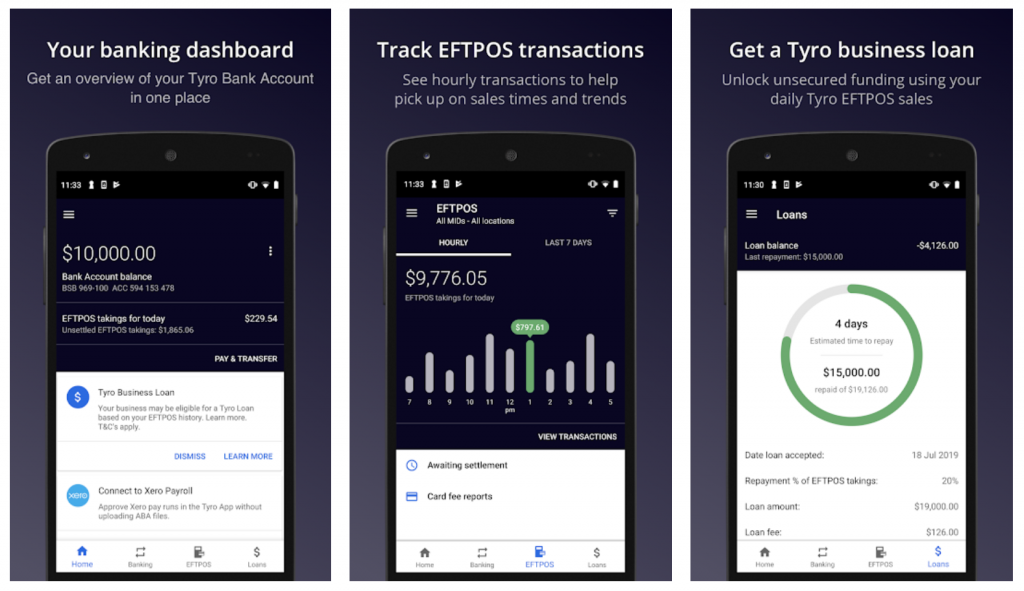

If you need to do EFTPOS/credit card processing as part of your business Tyro is cool. I worked on their mobile app a few years ago. Otherwise I use commbank as my main business account because the fees are cheaper than westpac.

Investment Apps

Learning to invest

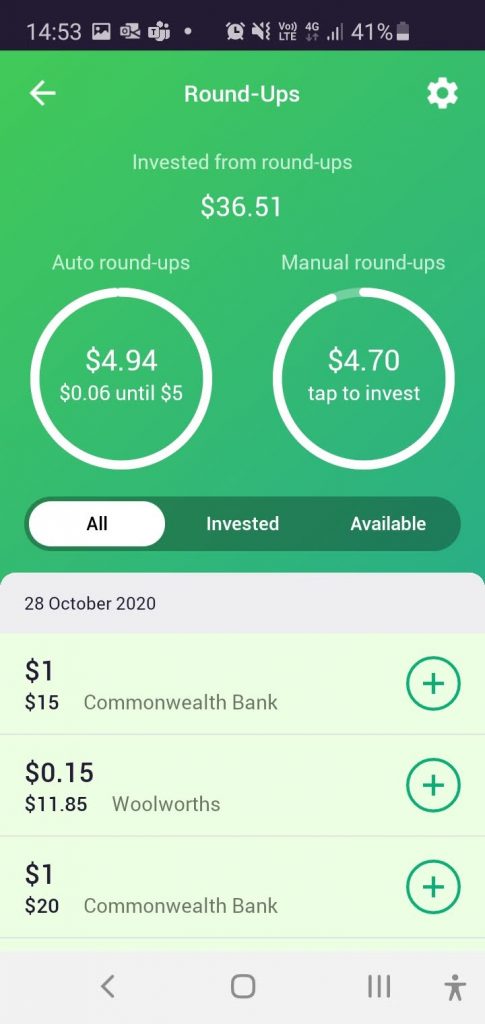

CommSec pocket is great if you are learning to invest and has a minimum investment of $50, but the fees can be expensive. Raiz has an auto roundup on bank transactions for the purposes of investing which is nifty.

Setting up automatic investments into an index fund is a great way to get started. You can read more about how I built up my own portfolio by investing a small amount each pay.

Education

I’ve installed both Finimix and Forex Portal for learning purposes. I’m not sure if they are useful yet. More time will tell.

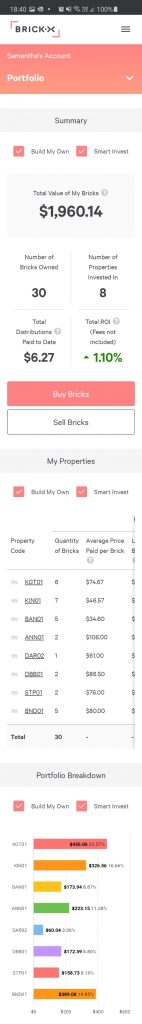

Building a portfolio

Most of my portfolio is held in CommSec (minimum initial investment $500). BrickX isn’t a mobile app but their website is mobile friendly and I’ve been using the platform to learn about property investment. BrickX may not be great if you need to liquidate those investment quickly though.

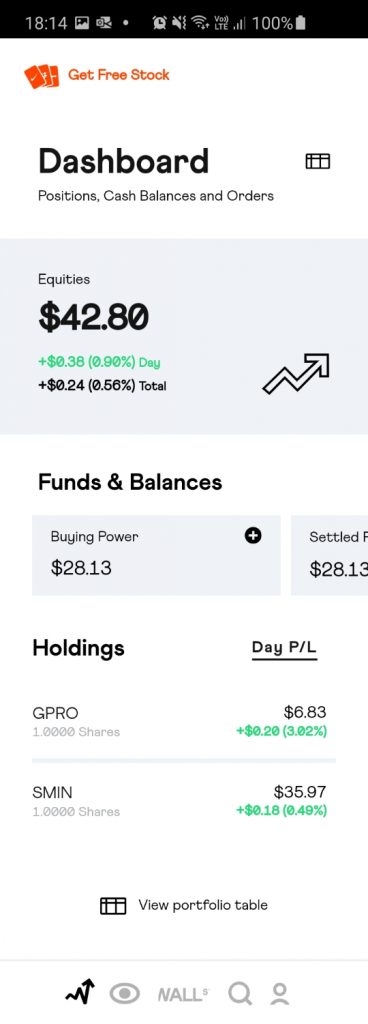

International Investing

I don’t have a large portfolio with Stake but it’s a clean looking app for US stock market trading. Just watch out for the foreign currency conversion fees, fast processing times will cost you.

Otherwise most of my international investing is via index funds traded via Commsec.

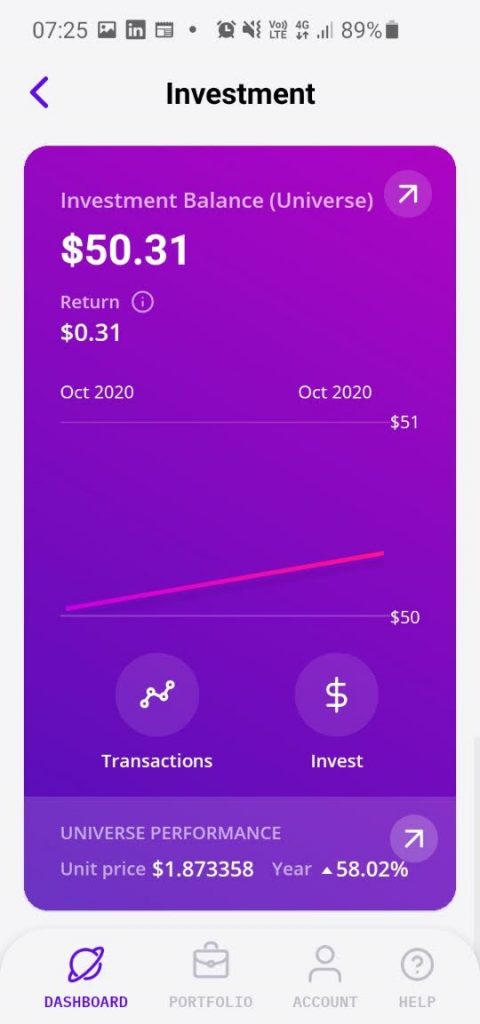

Managed portfolios

- Spaceship (low fees for less than 5K)

- Stockspot (minimum investment 2k)

- Hub24 (minimum investment option 20K)

This is starting to get towards the bigger end of town in terms of minimum investments. If you have a larger portfolio these options might be worth considering. These products aren’t all mobile apps but they have very attractive web portfolios for checking this stuff while on the go.

I don’t have much invested in spaceship but their managed portfolio has exploded recently mostly due to US tech companies doing exceptionally well during the pandemic.

Maybe these tech stocks are now overpriced? Who knows, the markets aren’t very predictable. You can read more on my adventure with investing during a crisis.

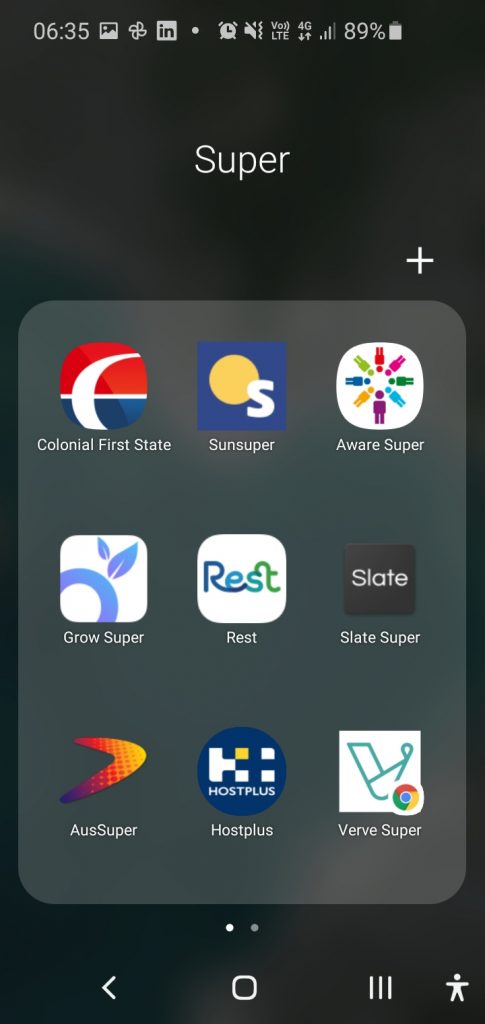

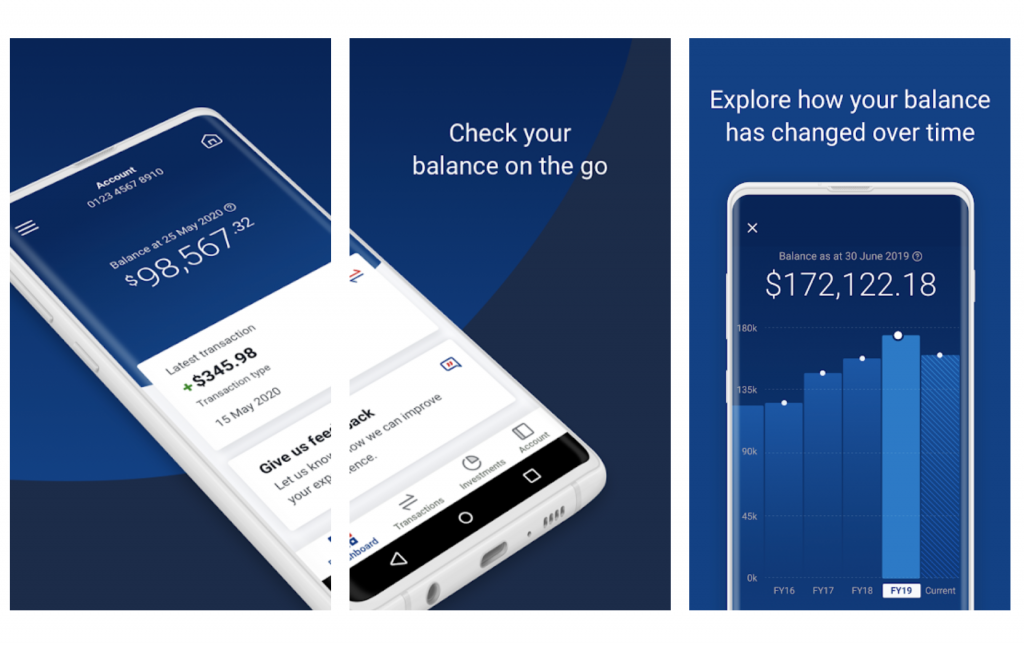

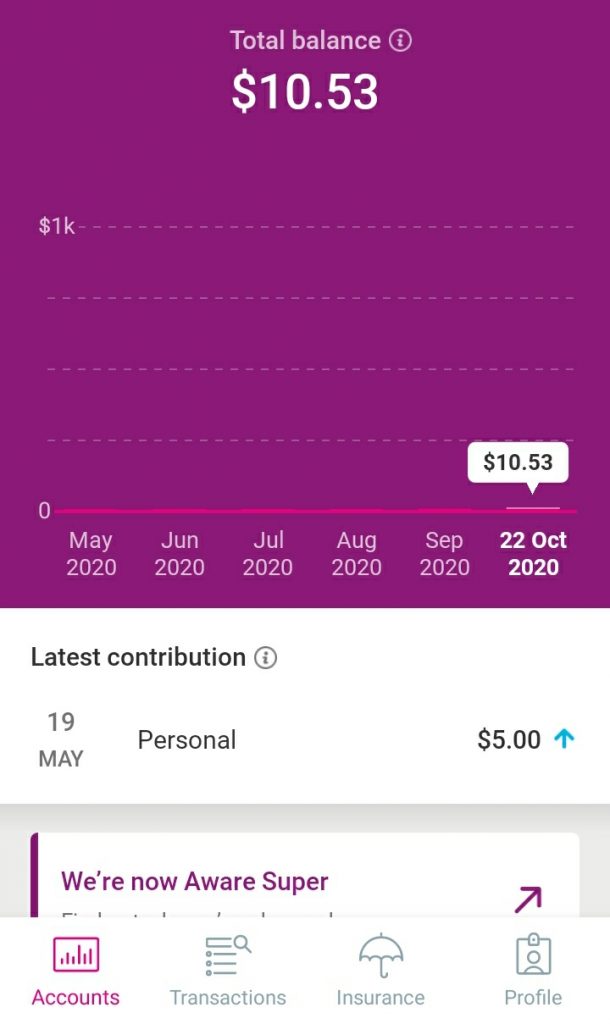

Superannuation Apps

I’m biased, the mobile app that I’ve been working on for the last 1.5 years is the best one here. However Sunsuper is my main super and I like Aware super. Grow is also pretty but it was confusing to use at first.

You can read more about superannuation mobile apps here.

What apps do you use for your finances? What features do you like the most? What’s been frustrating?

If you are interested in learning more about finances, I highly recommend checking out the My Millenial Money podcast.

1 comment