Financial Independence Retire Early (AKA FIRE) is a movement that’s been taking the internet and high paid young professionals by storm. The idea is fairly simple:

- maximize your income today

- maximize your savings for the near future

- grow an investment portfolio

- then draw down 4% of your investment portfolio forever

However, I think there’s some issues with the simplicity of this process. This blog post will go through some of these issues.

Table of Contents

Example scenario

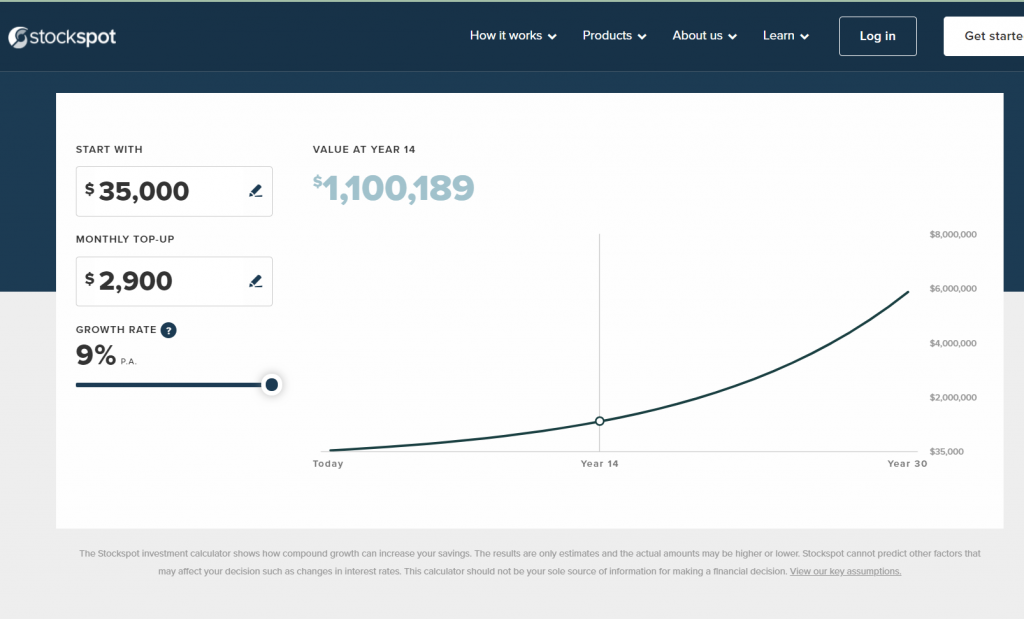

Say a hypothetical 25 year old needs 40K a year to maintain their current lifestyle. And they are earning 100K per year before tax. They would be about 75K a year after taxes. This means they could save 35K a year. They would need a million dollar portfolio to support a 40K per year income (the 4% rule in FIRE). It would take them atleast 14 years to build this portfolio.

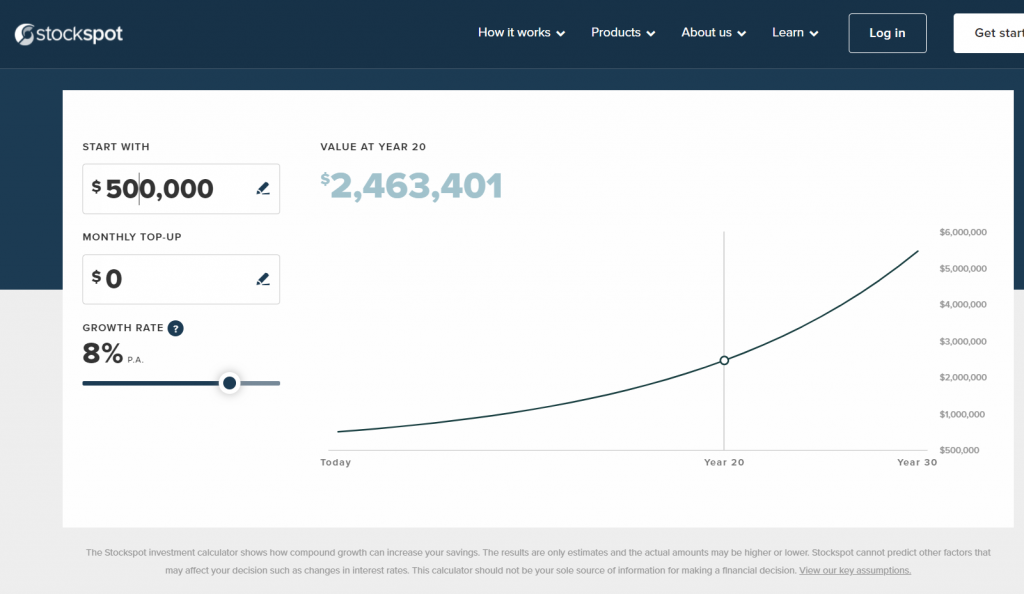

If someone started these savings when they were 25, by the age of 40-ish they could stop working. This FIRE calculator puts retirement in 18 years. So they could easily retire by 45.

Issues 1: Pre vs post tax

With the above sample scenario, They need 40K per year post tax to support their lifestyle. They might need a bit more to make 46K a year pre tax to have that level of income in Australia. If they want to draw down 4% they actually need a bit more than 1 million, say they need 1.2 million instead. Might as well say 20 years to hit this target.

That’s now saving for a few more years for this hypothetical 25 year old.

But even then this assumption is flawed. If they are selling stocks the are some CGT (capital gains tax) discounts that might apply. Basically if you hold stocks for more than 12 months you only need to pay tax on 50% of the profit counts towards your assesable income.

E.G. Say today I bought 20K of stocks and in 20 years time sold them for 40K. I’d only count 10K ((40k – 20k) / 2) towards my assesable (taxable) income. If that’s all I earned as income that year that’s all tax free, baby. Because our current tax free threshold is 18K.

However dividends and rental income will be taxed at income tax rates. Though some shares might have franking credits. Gah this is getting confusing.

Issue 2: Not adjusted for inflation

Some of these numbers don’t take into account inflation. There’s a big difference with what you could buy for $10 in 1980 vs today. That $10 in 1980 would need to be $44 today (Source: RBA inflation calculator).

That’s why the 4% rule is there, it’s meant to keep inflation in check but it only applies to the draw down rate. On average if a portfolio grows at 8%, that’s 6% when adjusted for 2% inflation. Rounding down to 4% apparently gives a better buffer for a safe draw down figure.

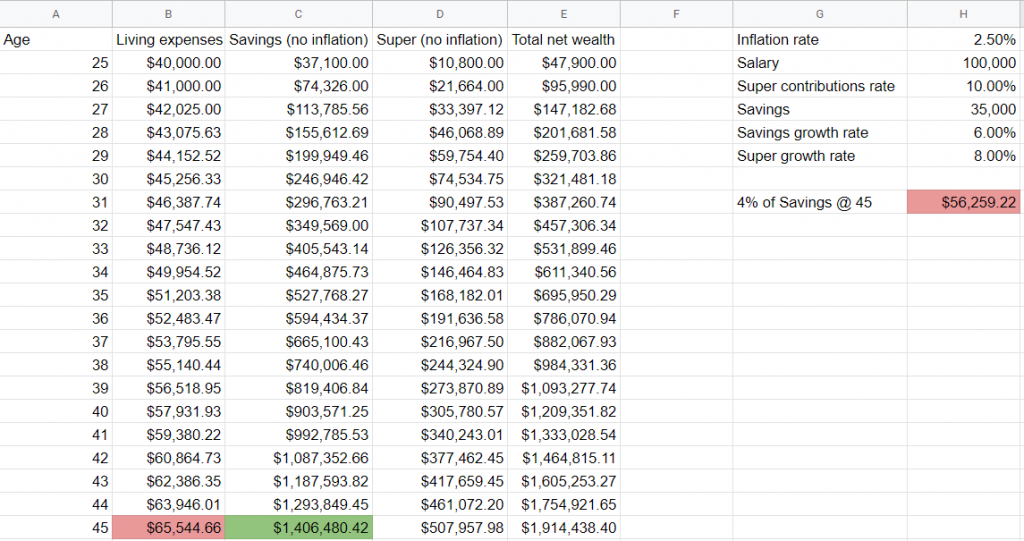

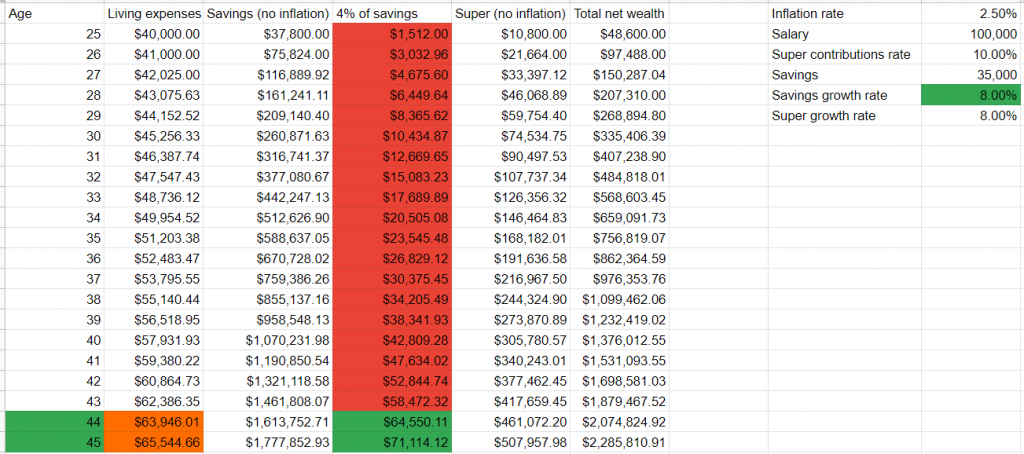

But also this doesn’t take into account that at 45, this person will need more than 40K a year to support their lifestyle simply due to inflation of every day costs. If inflation was at 2.5% each year they would actually need 65K a year to support today’s lifestyle. Their 1.4 million portfolio won’t cover 65K at 4% drawdown. If their returns were only 6% before inflation.

They would need to get an 8% return from their investments, and build up to 1.6 million to have a decent enough portfolio to have a safe draw down amount.

Issue 3: What about super?

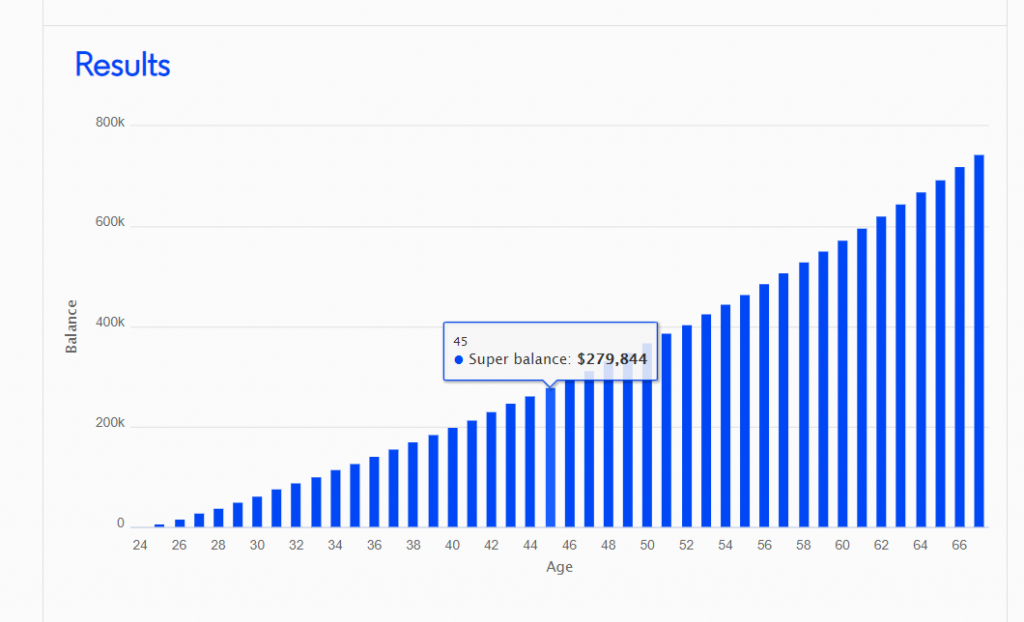

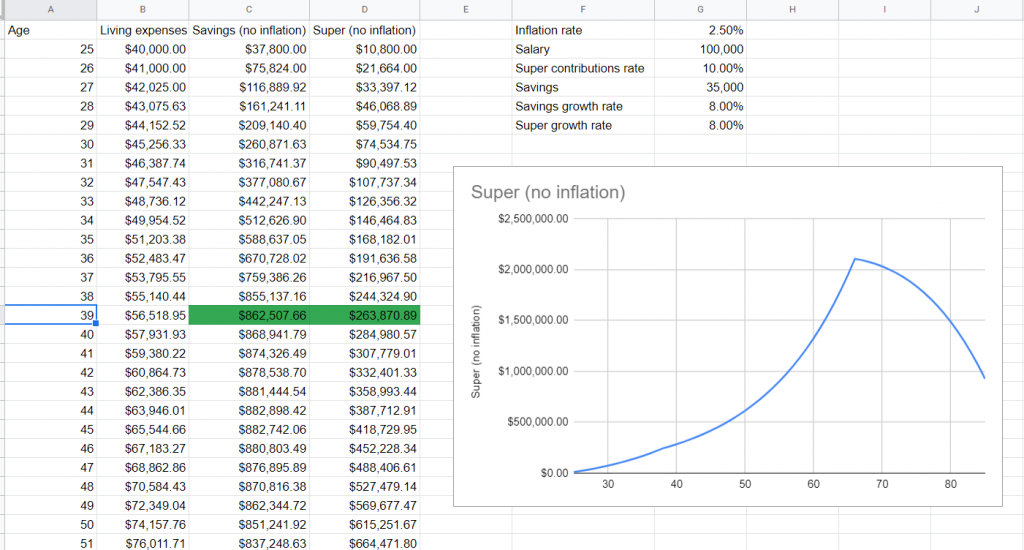

Here in Australia we have compulsory retirement savings called superannuation. Which is often shortened to Super. While this 25 year old was working their employer would have also been contributing 10% on top of their salary into super. They’d have nearly 280K in today’s dollars (500K not accounted for inflation) by the time they are 45.

If they stopped working at 45, that 500K amount could grow to 2.3 million by the time they are 65 simply by the magic of compound interest.

Alternative scenario: work until 39

This person could work until 39, draw down their savings until the age of 65 and then start drawing down their super. Even if they switched their super to a more conservative 5% growth rate from 65 they’d still have just shy of 1 million left by the time they are 85.

The great thing is, when you draw down income from super it’s all tax free. They no longer have to earn a bit more to cover income taxes.

Issue 4: Why is it infinite drawdown?

Once you start accessing your super, generally if you are above the age of 60-ish, you should aim to draw down more than your growth rate. What are you going to do with that money once your dead?

I think projecting retirement income until the age of 85/90 is ok. If you want to be conservative, model until the age of 95. In Australia we have the age pension as a safety net if you outlive your savings.

It’s not the end of the world if you draw down more of your investments than what they grow at. You don’t need your money to last forever.

Issue 5: that 4% rule

This rule was created when interest and bonds had higher returns. It was when people had more conservative portfolios (50% bonds) and based on 30 year rolling averages. If you are retiring for longer this number might not apply.

Here’s a you tube video that say’s that 4 % should actually be 3.5%:

Here’s a video saying it could be up to 7% if you are flexible with your spendings.

Issue 6: Emergency expenses aren’t accounted for

What if they need surgery later on life? Or need to replace their car? These types of big purchases aren’t accounted for and can put a real dent in progress towards their goals.

Issue 7: No accommodations for wage growth

What if this person get’s a better job? or pay adjustments to align with inflation? These calculations don’t take these increases into account.

Conclusion

Modeling retirement income is a challenge. However working towards financial Independence is a worthy goal. I hope this post didn’t put you off working towards that goal.

If you’d like to read more, there’s this post on financial freedom, and you don’t need a lot of super. Here’s the spreadsheet I used for some of the projections in this post.