I have been obsessed with finances and I’m studying a financial advice degree part time. This here is NOT personal financial advice, but it’s a walk through of how I’m managing my finances. This is for the Australian market. I don’t know the best way to manage taxes/save for retirement in other countries.

Table of Contents

Company Structure

Sole Trader vs PTY LTD vs PAYG or some other structure. What structure is best for me? I’ve opted for a PTY LTD. The main reason is I needed a company structure to accept my current contract, it helps protect my personal assets and it gives me more flexibility over how I pay myself. A PAYG company would give me a fixed salary. With a PTY LTD, I can pay myself whenever and whatever I feel like. Here’s an article that compares PTY LTD with a PAYG structure.

Once I rebuild my emergency fund I’m going to max out my concessional contributions into super, so having the flexibility to manage how I grow my super is important to me.

In the future I might use a family trust structure. I would do this when my company is no longer deemed “personal service income” and if my partner was taking a break from work. I could use this to distribute the business income across the two of us and we’d pay less tax overall. This isn’t tax avoidance if I say the reason is to support my family *cough cough*.

Personal Service Income

As a tech contractor, most of my business income will be deemed as personal service income. This means instead of paying company tax rates of 25% on any spare money I don’t pay myself, it all gets taxed at marginal income tax rates. And if I’m doing a decent amount of contracting, this is likely to be the highest tax rate of 45%. So no lovely company tax rates for me 😢.

To get out of this category I can apply for a personal services business (PSB) determination and the PSI rules do not apply. One way to do this is to take on a second unrelated client such that 20% or more of my income comes from the second one. There are other ways but the rules get confusing. I’m hoping that some passive income from online content can help me reduce this category.

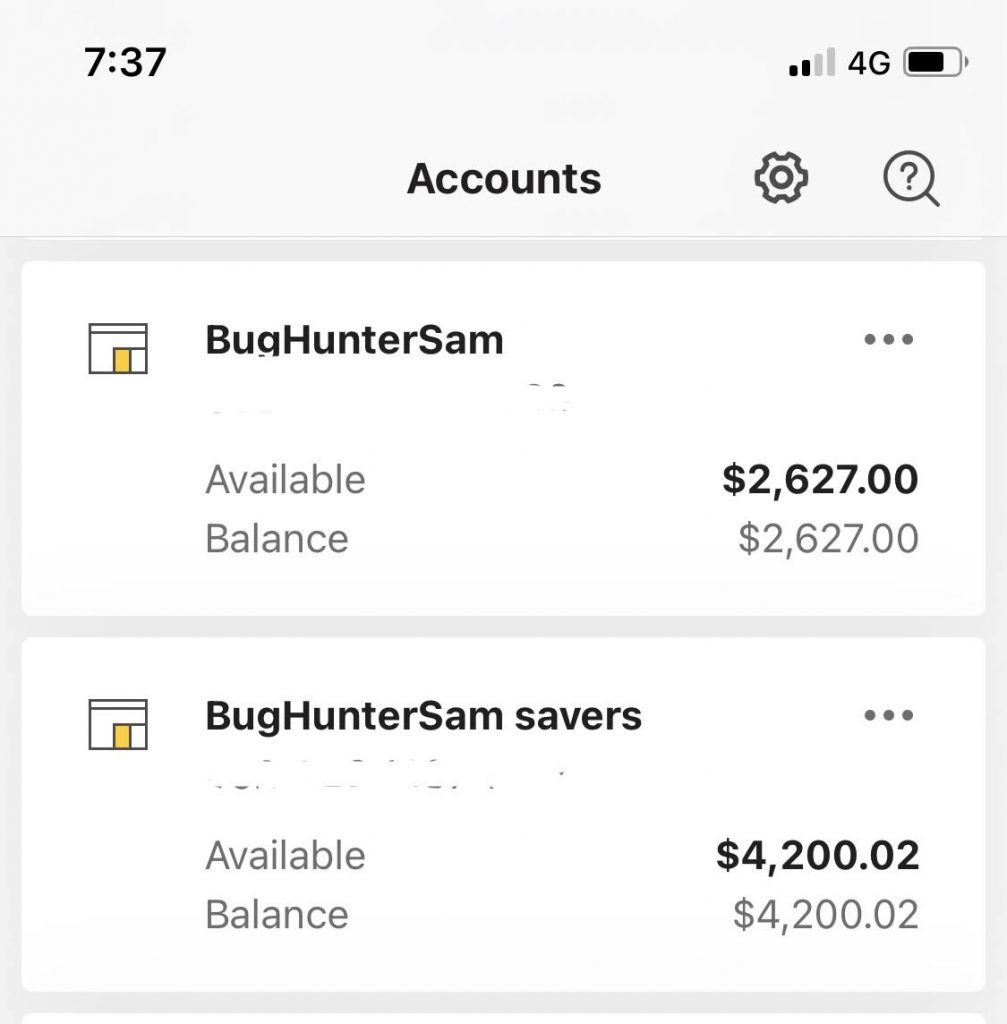

Bank Accounts

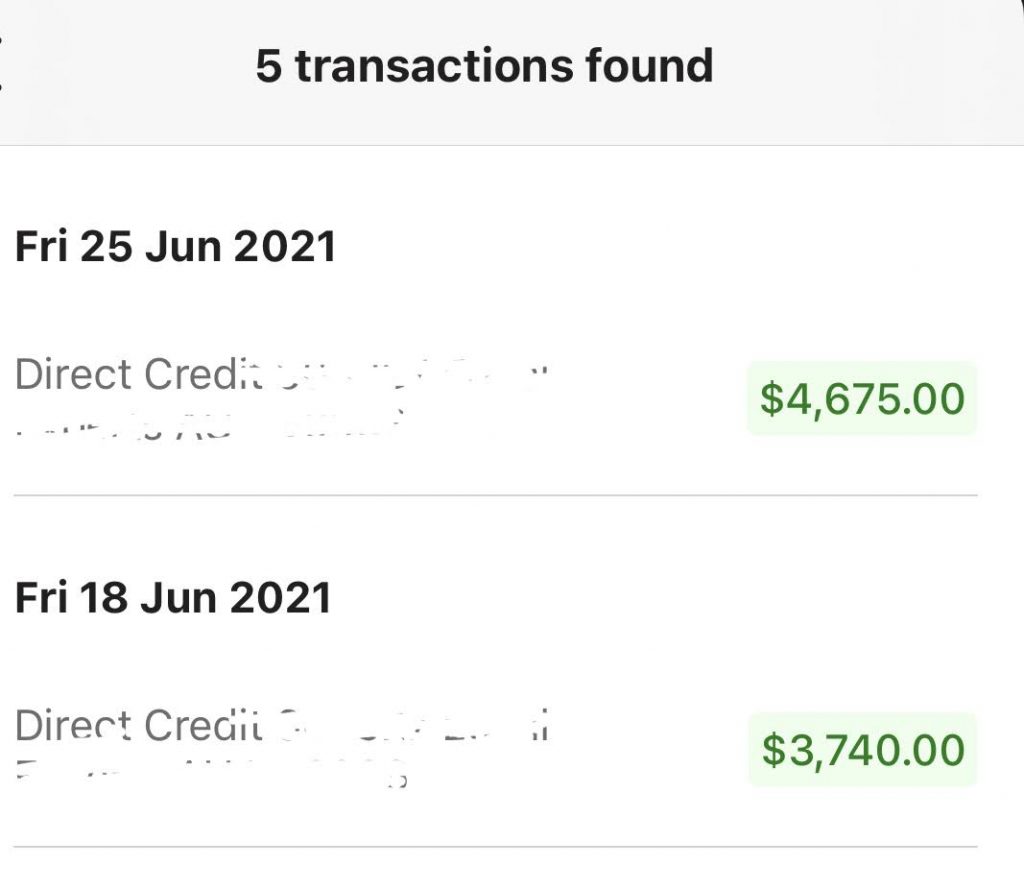

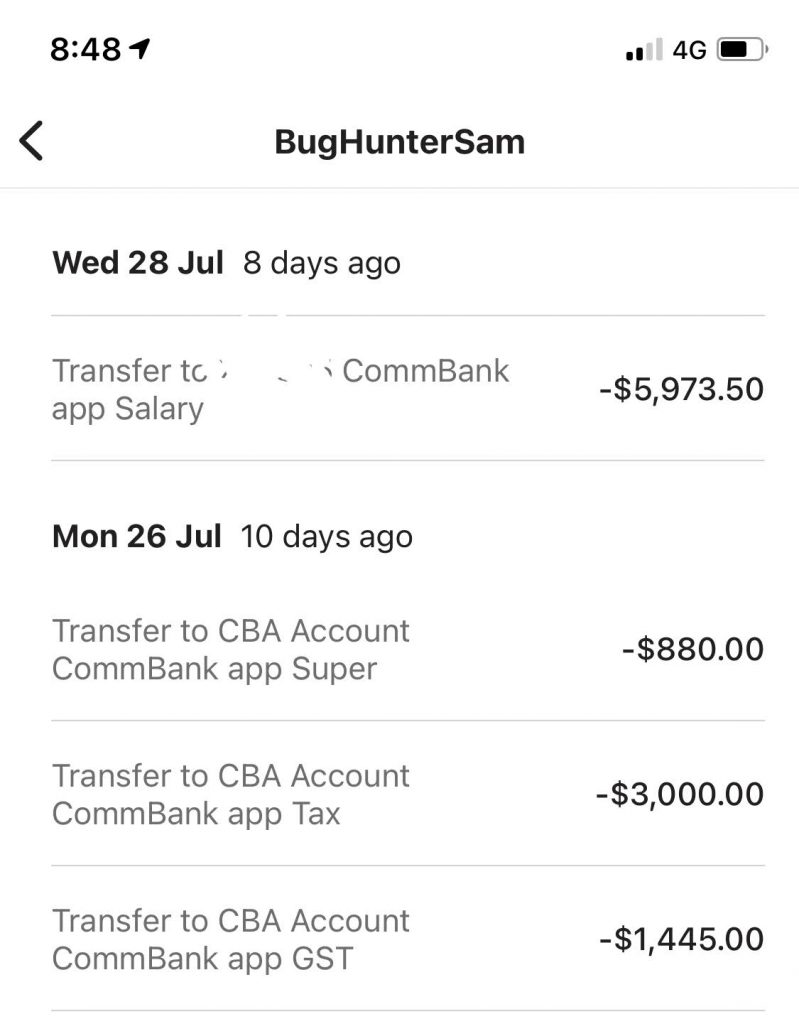

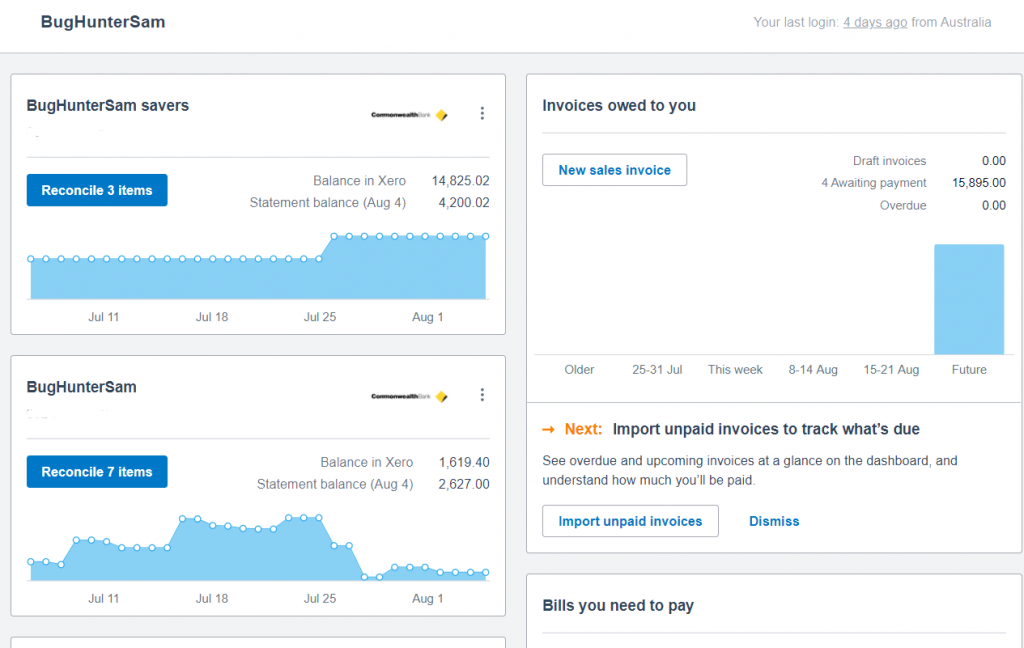

I have 2 accounts set up. My main business account and a savers account that I put aside my taxes/super into. The savers account has a 0.01% interest rate when I have more than 10K in it. Much interest. Such wow. I have my weekly invoices paid into my main account and I pay myself at the end of the month.

Salary, Taxes and GST

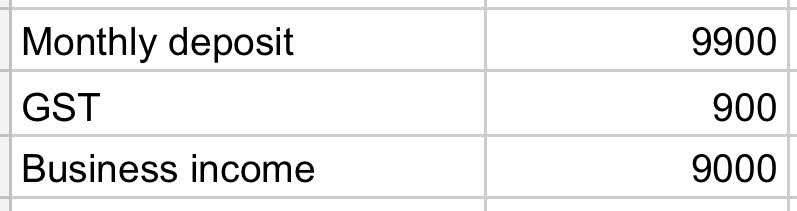

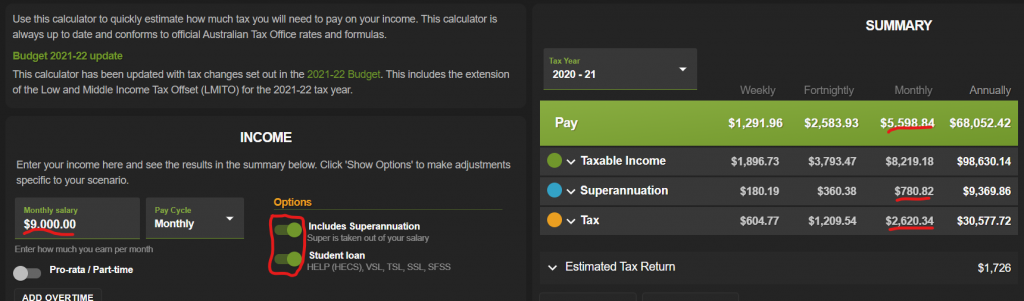

At the end of the month I count up the total of paid invoices into my main account. For this example say I had $9900 of invoices come in for the month.

Deduct 10% for GST. Then deduct what I spent on the business.

The remainder I put into this pay calculator to figure out how much tax/super I should pay (I make sure to check the include super & HECS boxes.)

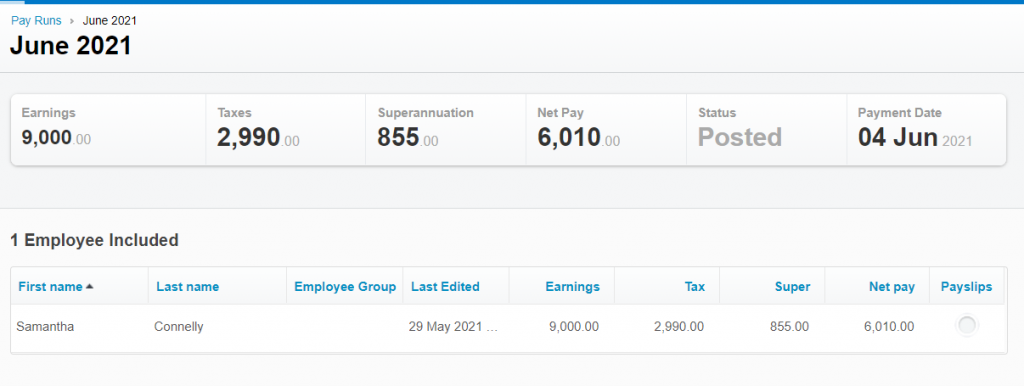

I then transfer the values I need to put aside, run payroll in Xero and pay myself.

Xero

I use Xero to manage my payroll, super and accounting. It is hooked up to my bank feeds and I reconcile expenses as they come in. I personally find Xero to be frustrating to use, payroll doesn’t work on mobile but it’s one of the “better” accounting tools on the market.

Accountant

Even though I’ve now studied taxation and know how to do my own taxes I use an accountant: Jacob Fahmy for external accountability. If I was the ATO and building an automated system to flag people for potential audit’s, doing your own company tax return would be something I’d flag.

Superannuation

As a company I only have to pay super once every 3 months. I can chose to do this at particular times of the year for a slight tax advantage. It can also take up to 10 days for your super fund to process the payment. Watch out for this, especially if you are trying to maximise your concessional contributions into super.

You can contribute up to $27,500 into super this year. If you do this with pre tax income it is taxed at 15% going into super. That certainly beats the 45% you might pay on your income tax. If you contribute more than the minimum 10% you reduce your taxable income and the amount of income tax. Putting extra $ into super is one of the most tax effective ways to save more $ as a high paid tech contractor.

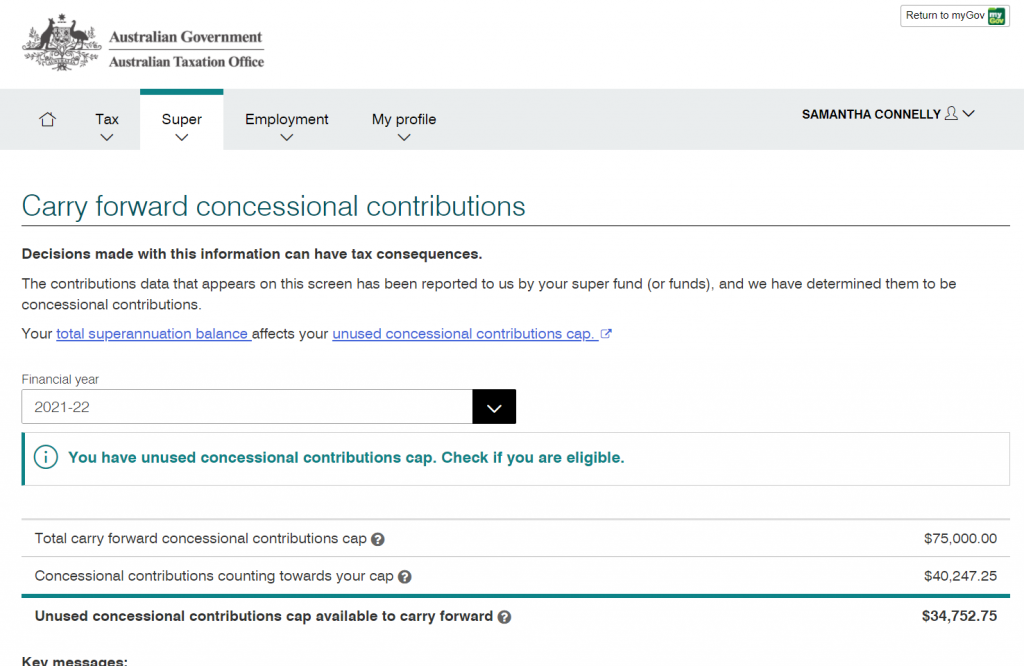

Last year the limit was $25,000 for pretax contributions. It doesn’t matter if you didn’t used all of limit from previous years. You can carry forward those limits this year, catch up on previous years and get a tax benefit in the process. You can check your previous limits in the ATO/super portal.

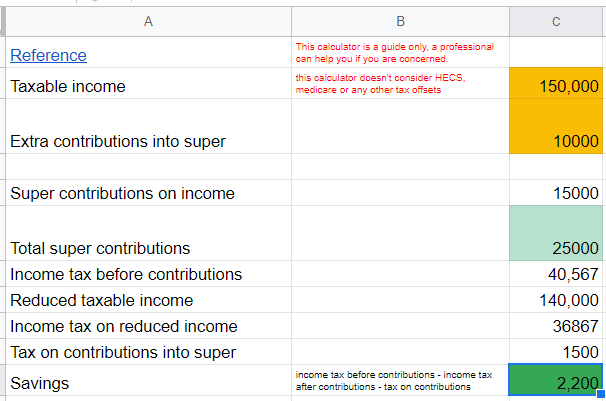

For example, say I earned 150K, my 10% contributions would be 15K. If I contributed an extra 10K into super I’d be under the 27.5K limit (15K + 10K = 25K), I would reduce my taxable income to 140K and I would have saved 2.2K in taxes by doing this. I have this spreadsheet you can copy and play around with.

Also you can withdraw these extra contributions as part of the first home super savers scheme. I’m planning on doing this in a few years time.

Budgeting

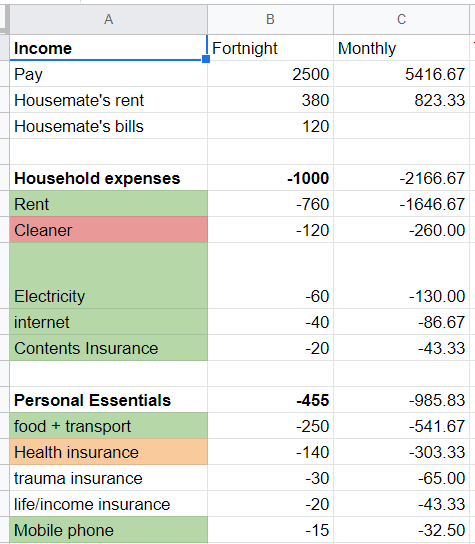

I use this spreadsheet to manage my budget. I used a green/orange/red traffic light system to figure out what are essentials and what would be cut if I suddenly had to tighten my budget.

Emergency Savings

Once I have my credit card debt paid off (which is 2 months away), I’ll be rebuilding my emergency fund. As a contractor I’d like to have 6 months worth of living expenses saved and for me this is 15K.

I have more blogs on finance if you are interested in reading more.

Hey Sam,

How does it work for you in regards of taxes? – Your services are PSI and, therefore, should be taxed at your marginal tax rate via your personal tax declaration, correct?

If you arrange your finances as described above, the company revenue is 0 AUD since you pay yourself at the end of the month, correct?

In theory yes, my company revenue is pretty small. However in practice I tend to pay 2 to 3k in company taxes at end of year because I have some cash flow put aside for liabilities (like salary, super and GST) and this gets reported as “profit”, however come the next financial year this reduces the next years profits.

It evens itself out over a few years, but my first year I was stung with a 6K tax bill, my second year was at a loss so I can carry foward this loss for future years. This means from next financial year I can have around 30K of profit and not be hit with a PSI tax bill.