This is not financial advice and you should seek out a professional if you have any concerns.

The super industry would love to have more of your money and wants to encourage people to save more for retirement. This isn’t a bad thing, BUT it’s easy for people to get stressed and think they don’t have enough saved.

This blog post will go through some projections for a hypothetical person based on today’s information.

Caveat: we can’t tell the future and all of this is educated guessing.

Table of Contents

Meet Charlotte

Charlotte is a made up person for this blog post. She’s 45, spent most of her time out of the workplace raising her 2 daughters who are now 21 and 18.

She recently went through a divorce and was able to keep the family home, her ex kept their super which was valued at 420K. Charlotte is receiving some financial support from her ex until their daughters finish their first degrees.

Her daughters are studying and want to live with Charlotte until they finish. It’s a 3 bedroom house in South Morang, Victoria valued at 380K which is all paid off. She also owns outright a 2011 Kia Sportage car valued at 15K. She has no other debts or obligations.

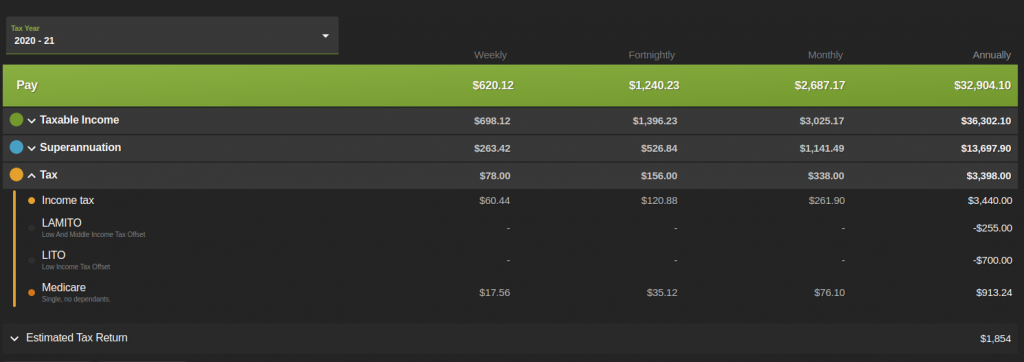

She has no super and is concerned about how she will fund her retirement. She recently started working on 50K a year (including super) as a office receptionist and aims to retire at the age of 70. She gets 40K a year after super and taxes.

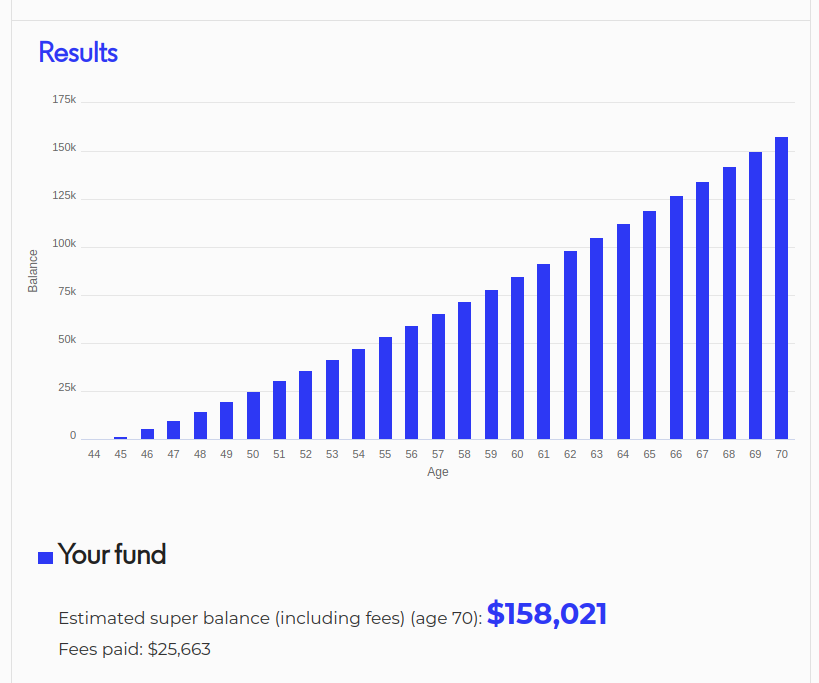

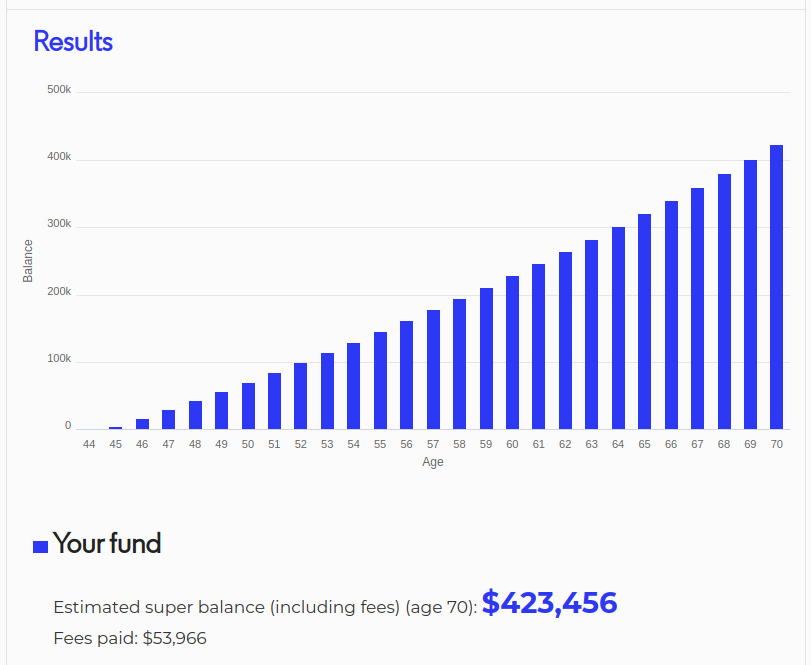

Scenario 1: does nothing extra

On 50K a year and working for 25 years, Charlotte with have around 158K in superannuation by the time she gets to 70. She’s considering working part time beyond the age of 70 to help supplement her income as her mum who’s 70 is quiet fit, active and still doing a bit of work (mostly selling cakes at the local market on Sunday’s).

What is a comfortable retirement?

A modest retirement for a single person is $27,987 per year and a comfortable retirement for a single person is $43,901 per year (source: ASFA Retirement Standard). A comfy retirement involves the occaisional oversees holiday and driving a fairly nice car.

Income replacement rates

A rule of thumb for income in retirement is 70% of your salary before retiring because people don’t need to do things like service a mortgage or save for retirement any more. People can aim for 90% replacement rate if they don’t own their own home and will be renting in retirement.

Renting in retirement

Renting in retirement is one of the biggest financial stresses you can put yourself under in your old age. Atleast Charlotte won’t have to worry about this.

70% replacement rates

If Charlotte was aiming for $28,463.47 per year in retirement (70% of her current take home salary) she would be able to get most of this from the government pension.

Maximum pension

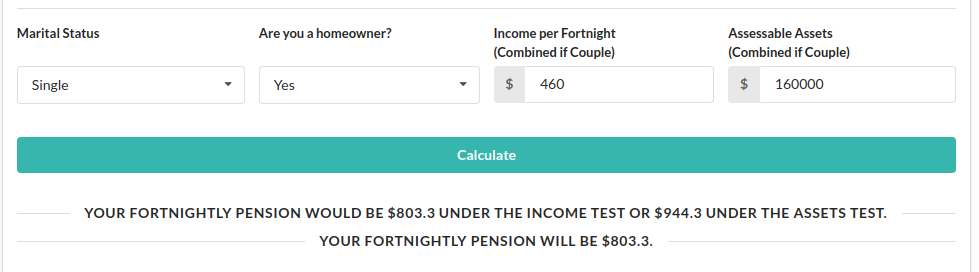

The maximum Age Pension for singles is $944.30 a fortnight or $24,551.80 a year (source: Service Australia). She could continue to work part time (earning up to $7,800 per year before impacting her pension, source: Service Australia) or draw down the remainder ($3,911.67) from her super in her retirement. She would need to drawdown a minimum of $3,950 (2.5%) of her super at the age of 70 (source: ATO). This minimum drawdown is normally 5%.

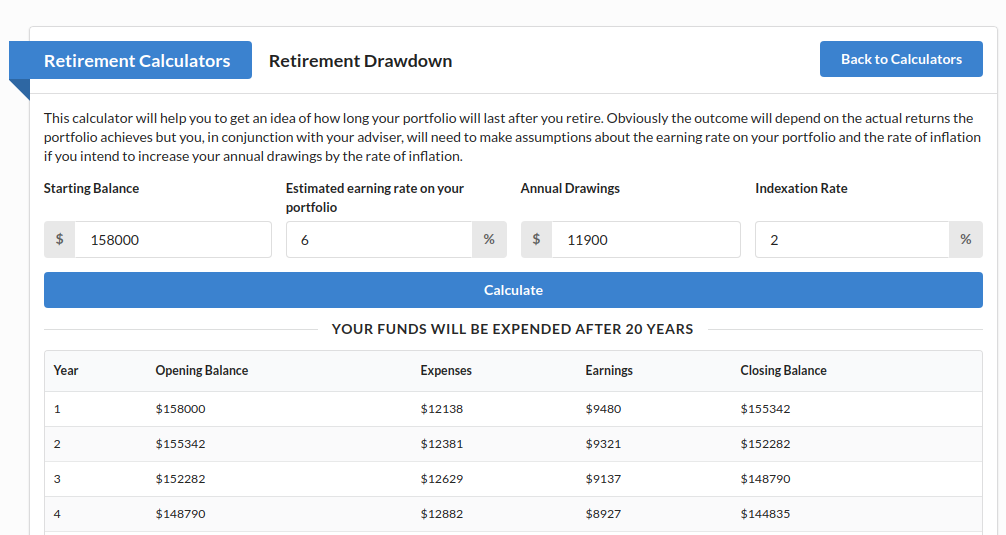

Infact, assuming 6% returns and 2% indexation she could drawdown $11,900 a year from her super and it would last until she turned 90.

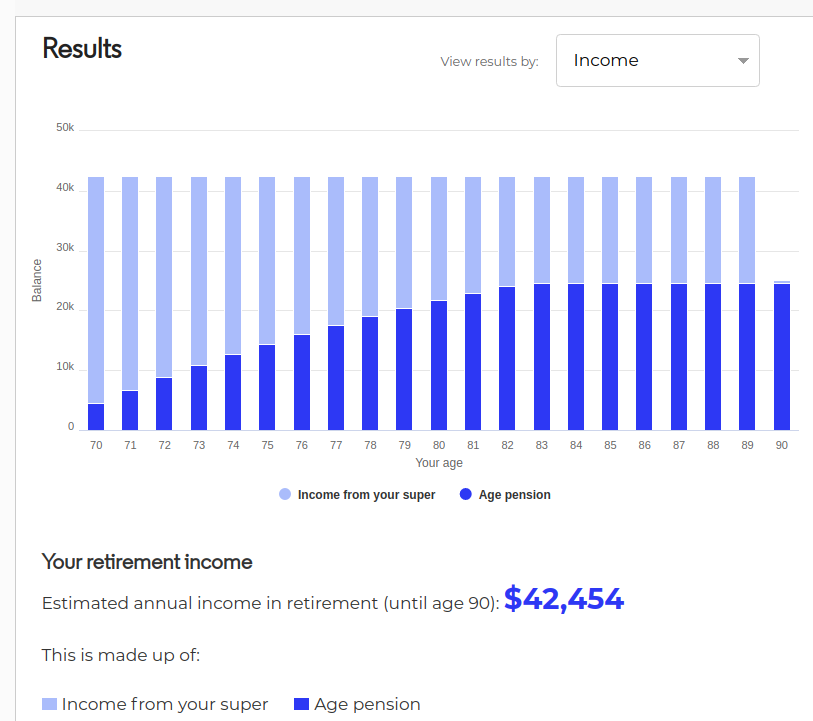

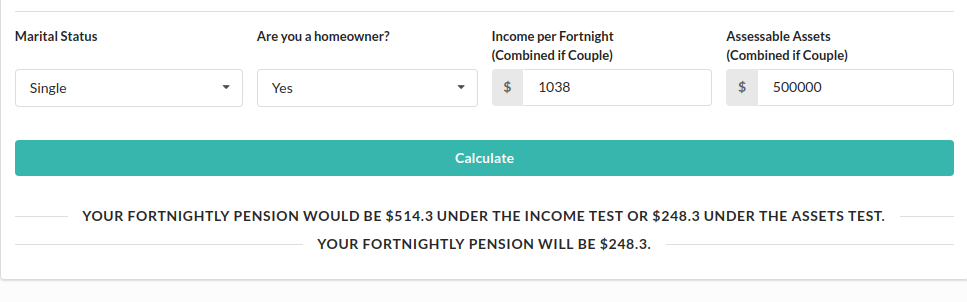

If she did drawdown $11,900 a year ($457 a fortnight) from her super she’d be able to get $803 a fortnight from the pension. Which is an annual income of of 32K.

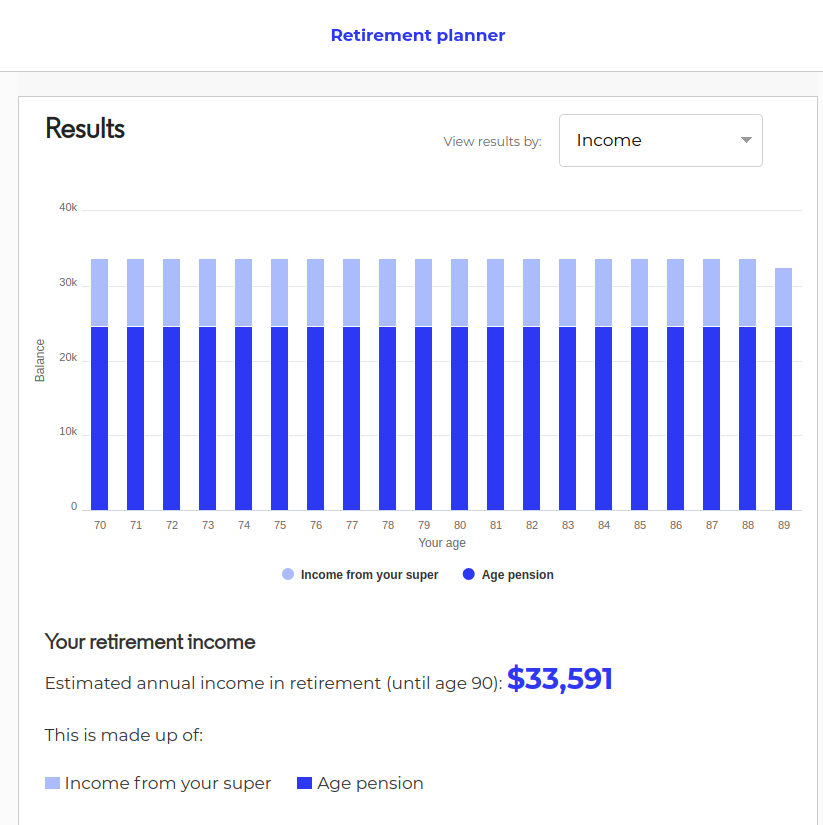

Moneysmart is projecting $33,591 in annual income from both pension and super drawdown. With part time work, Charlotte could generate the same income she is on now in retirement.

Scenario 2: contributes $360 per fortnight into super

Charlotte would have 420K in super and could draw an annual income of of 42K per year.

However this would reduce her current take home pay to just under 33K per year. She would still save on some taxes as super is generally taxed less than personal income but her pay is low enough that it might not be the best thing for her. (Source; ATO: Concessional contributions)

If she can live on 33K a year now why would she need 42K a year in retirement?

Scenario 3: Adding inheritance to super

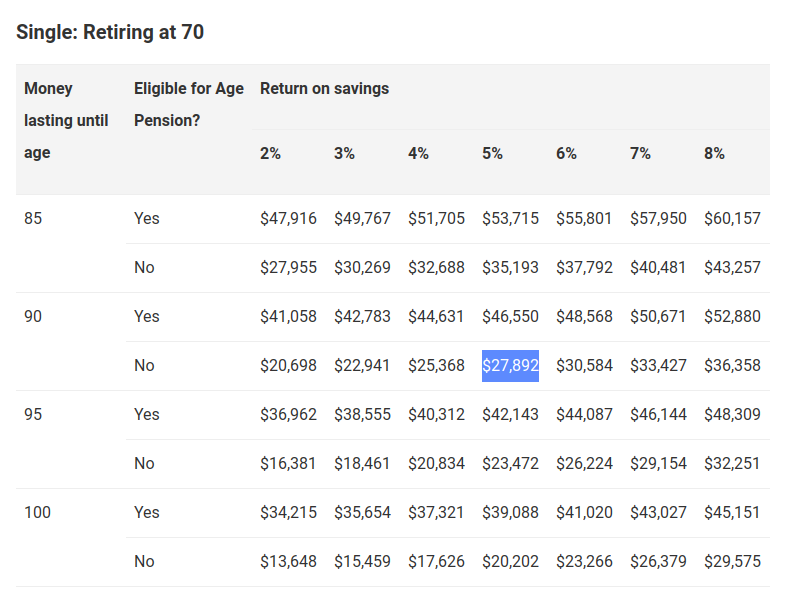

Charlotte might be able to receive some inheritance from her mother later on and makes extra contributions into super. She eventually ends up with 500K in super at the age of 70. Assuming 5% return on her investment, no government pension and it lasting until she was 90, she could drawdown 27K a year from her super.

However in this situation she could still receive a partial pension from the government. Maybe Charlotte wants to be independant of government hand outs?

She could also make a downsizer contribution into super if she sells her family home at 65. (Source: ATO).

Aged Care

Charlotte is ok with having less income as she gets older and becomes less mobile. If she does need to move into aged care facilities she will sell her home to fund it.

Should Charlotte contribute extra into super?

She would be applicable to receive some government co contributions. If she added an extra $1000 a year she could get an extra $500 from the government (source: ATO).

But it really depends on what Charlotte wants to do with her money. She could have more income in retirement at the expense of current income or she could save what ever she can over the next 5-10 years to help her daughters get into the housing market. Or she may want to go on a holiday with her eldest daughter when she graduates.

She may also get pay rises in the future or start dating someone else and this could all change her projections.

Conclusion

Income in retirement is a beast to project, but I hope the tools I’ve mentioned here can help you. In Australia we are very luck with the support we receive and as long as you own your own home, a reasonable retirement is almost guranteed.

Many people die with a good chunk of their super still intact (Source: Retirement income review). Why spend a good chunk of life saving for retirement if it’s not going to be fully utilized? The government pension can be seen as a safety net if you outlive your super.

The government isn’t likely to get rid of the pension completely but it’ll be interesting to see how it changes over time.

I love it Sam and you have me thinking about this critical topic – building my super!