Meet Eric, he’s a 25 year old who enjoys hanging out with friends. He earns a 70K per year salary and spends about 40K a year on living expenses. As a single bloke, he’s not super keen on jumping on the property band wagon. He enjoys having the freedom to live wherever he likes and doesn’t want to be tied down with a mortgage. Eric is a made up person for the purpose of this blog.

I’ve used this spreadsheet for Eric’s projections.

Table of Contents

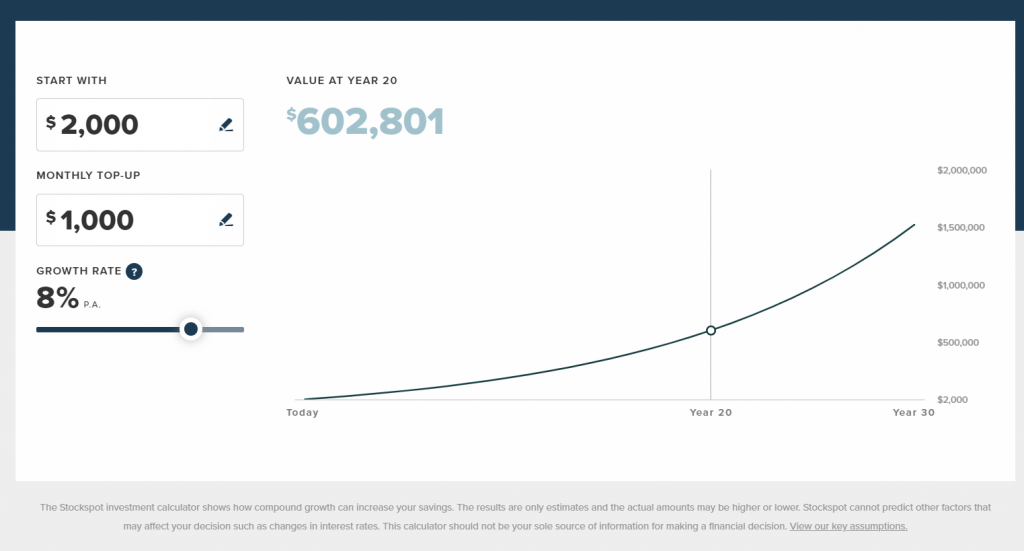

Investing $1000 a month

Say Eric invests $1000 a month, automatically after he gets paid. He chooses DHHF. He did some research into VDHG but wanted to avoid the bonds component. He also had a read of Passive investing Australia.

Note: This is NOT personal financial advice. These are two common high growth index/ETF funds on the market.

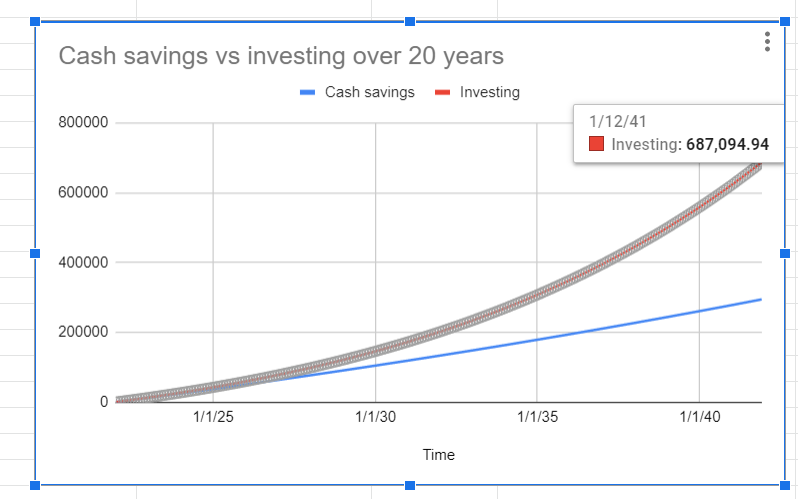

Over 20 years his investment has grown to 687K. It would have only been 294K saved if he had just kept that money in the bank.

This doesn’t take into account brokerage fee’s, I’m assuming Eric covers this extra cost (commsec has brokerage of $10 per trade for trades under $1000). Commsec pocket is $2 per trade up to $1000, this would be cheaper for Eric if ETHI was his investment option of choice.

One of the issues with this investment option is it doesn’t give Eric any property exposure. DHHF is all stocks. He could use VAP (or REIT but this one hasn’t performed as well) later on which are indexes geared for property that he can buy on the stock exchange. If he wanted 20% property in his portfolio he could buy $1000 of VAP once every 5 months instead of putting his $1000 into DHHF for that month.

This is not a product recommendation, I am biased towards commbank because I’ve worked on their mobile technology. There are plenty of other investment platforms out there. There are over 200 index funds/ETF’s on the ASX now.

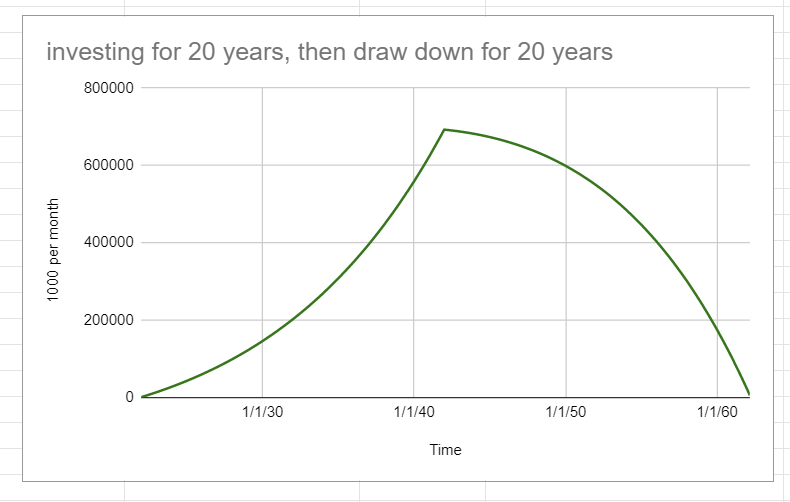

Draw down over 20 years

Eric could then draw down that investment over 20 years to cover his basic living expenses. Maybe he needs to take some time off from work to help look after an aging parent. Or wants to spend a bit of time exploring the world.

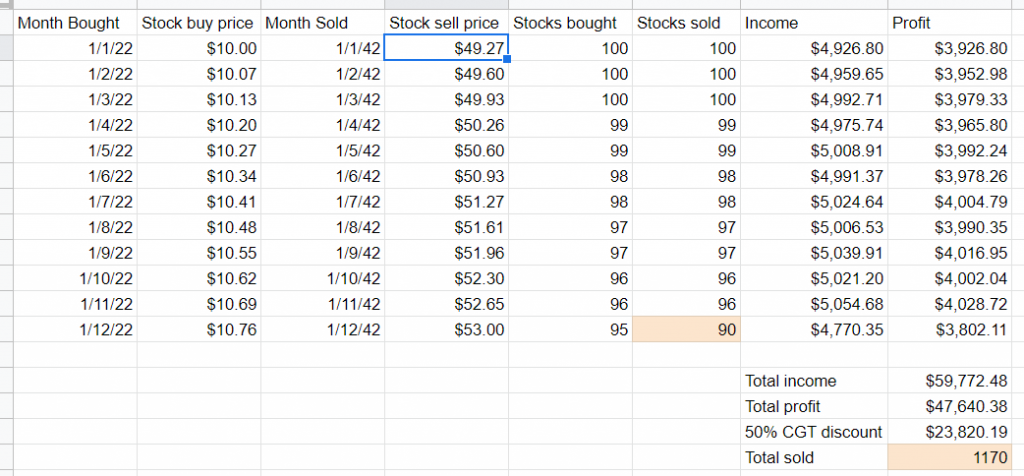

Let’s talk about CGT

When he’s selling down this portfolio, he’s adding the profits from his portfolio to his annual income. However because he’s held onto the stocks for more than 12 months he get’s a 50% discount before adding it to his assessable income. Assume those stocks started at $10 a share today. They’d be around $50 a share by the time he’s 45.

His profit is his sell price minus his buy price. Which will be around 47K. He’d add half of that (i.e. 23K) to his income for that year. If the tax free threshold increases over the next 20 years, he may not need to pay any taxes on that income. Otherwise he’ll pay his income tax rate on that profit.

If he sold it all in 1 year

Say he wanted to use that 687K to buy an apartment, start a business or do something else with. He’s invested just shy of 300K of cash over 20 years. His profits would be around $387K (687K – 300K).

He’d add half of that to his income, say 194K. He’d add that 194K to his income for that year and would pay between 58K to 91K (today’s maximum tax rate) in taxes doing this (based on today’s income tax rates).

If he could sell down his portfolio over two years (e.g. sell half in June and then half in July after the new financial year) he’d add around a 100K each year to his income and he’d pay 22K a year in taxes or 44K in total. This is assuming he has no other income over these 2 years.

He’d have to deduct 2 years of living expenses from this, he’d then have 520K (687K – 44K taxes – 120k two years living expenses) left over to safely put towards his new dream.

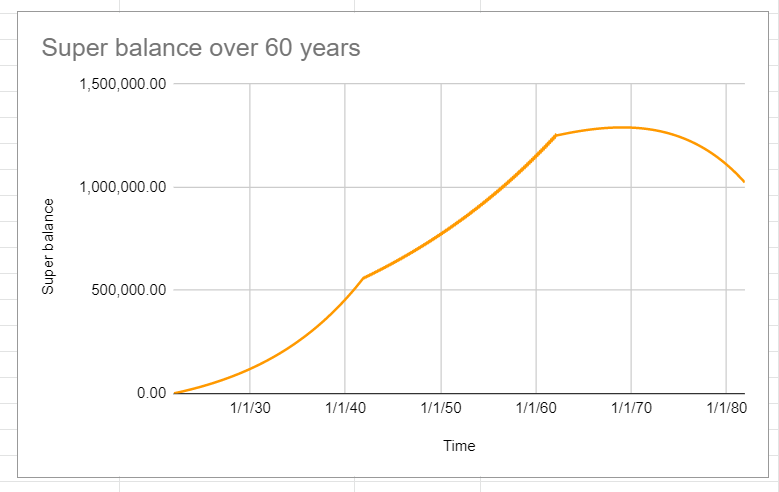

He also has super

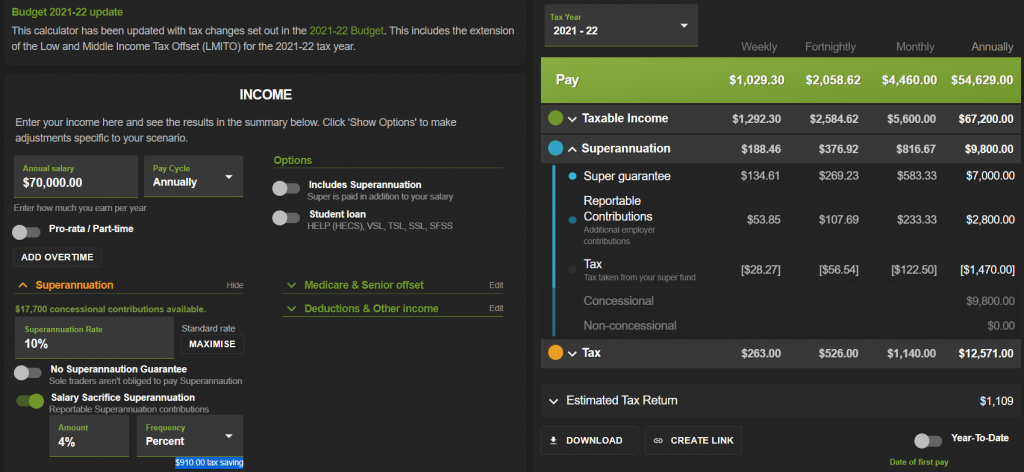

if he contributes to take his savings up to 14% (i.e by adding $235 per month on top of his employers 10% contributions) over the 20 years while he was working and then lets it grow while he took time off, he’d have 1.2 million in super by the time he’s 65. He could then continue to drawdown his living expenses and he’d still have over 1 million bucks by the time he’s 85. This would also net him a $910 tax saving each year in the process.

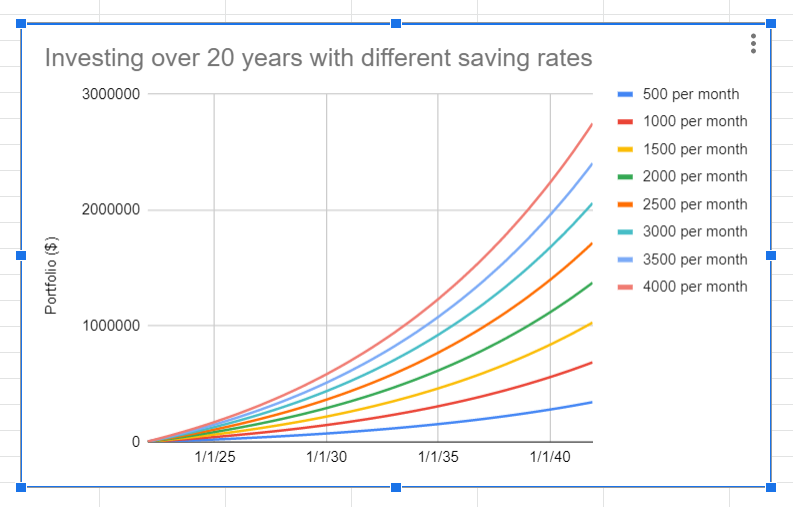

What if he could save different amounts?

Eric may not be able to save 4k a month, but he might get a pay bump in the future or change his career to land in a higher earning bucket. But just imagine what 4K a month over 20 years could look like?

1 comment