I recently tweeted there are 2 ways to grow wealth and work toward financial independence. That is spend less and earn more.

Now before you jump in and say, “3 – invest”, I view investing as part of earning more money. This blog post will go into more detail of how I do stuff under these two categories.

Estimated reading time: 8 minutes

This is not personal financial advice. This blog is a reflection on how I manage my own finances. A professional can help you achieve your goals or answer any other questions you might have.

Table of Contents

Spend less

Budget

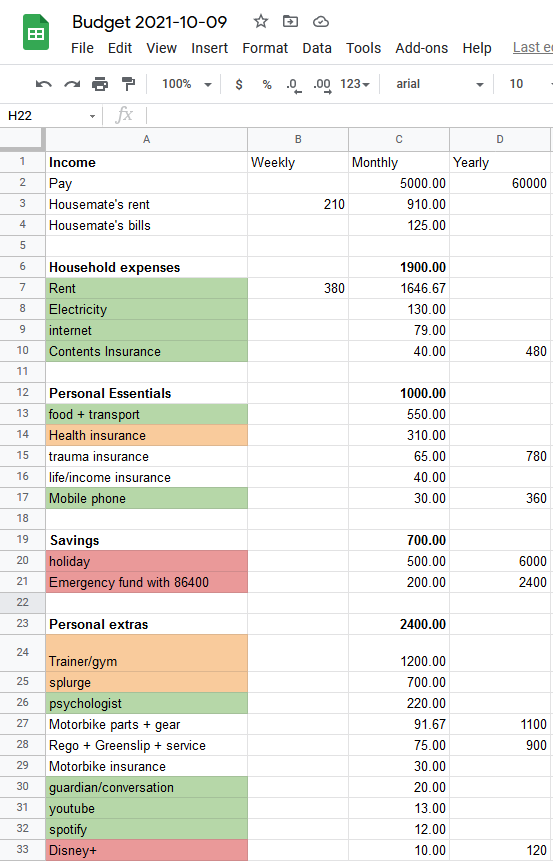

In order to spend less, you need to know where your money is going. I have this budget, my base lifestyle costs me $33K for the year are and I add luxuries such as holidays and personal training because these are ways I invest in myself and enjoy life. I started the pt after I paid off my credit card debt. I pay myself a base rate of 5K a month and save/invest the rest.

I use a green, orange and red traffic light system to indicate what are essential expenses and what could be reduced if the budget became tight (like if I was out of work for a few months).

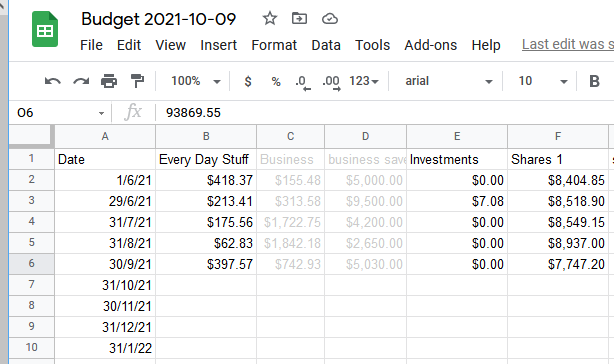

Every month I log into my accounts and note down my account balances, so I can track my net wealth over time. I’ve been doing this for 5 months now.

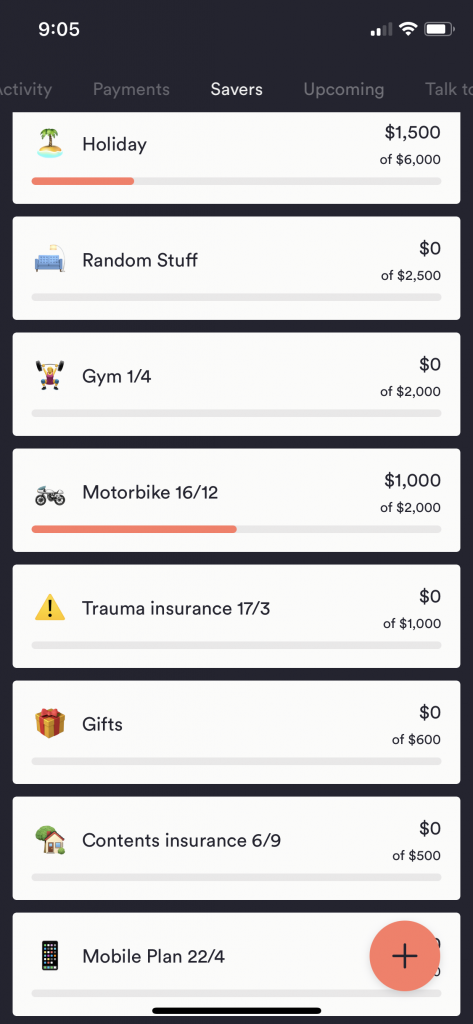

Budget for yearly expenses

I use to live pay check to check. And those annual expenses such as registration and insurance would always bite me in the arse. I now have buckets set up for them and a date of when I need to have enough to cover them.

I’ve also calculated how much they cost me per month and could add that much in automatically if I wanted to.

Eat more vegetarian

Eating vegetarian can be cheaper. I don’t eat vegetarian all the time but I have maybe 4 to 6 meals a week with meet and try to stick to more vegetarian stuff. I recently posted about a $5 food day challenge that I tried. My freezer is still full of the fruits of that labour.

Buy second hand

Recently I had my coffee grinder break. It was just a cheap $5 one I got when someone was having a moving out sale so I thought it was worth upgrading.

I initially had a look for a new one and then had a browse on Facebook market place. I ended up getting a second hand commercial one for $300. It’s huge but it didn’t cost me that much more than the top of the range one I was considering at JB HiFi.

I try to buy things second hand were possible. I furnished my whole apartment for 4K using mostly second hand stuff. The only furniture I bought new was mattresses and that was half of spend just there. Here’s a photo of my old pace:

I bought my iPhone second from a friend who upgrades every year. It’s an iPhone 11 pro that I got for $900 and I hope it’ll last me another 5 years.

Drive less car

Car loans are one big expense that eats into the budget. I have a motorbike and I had a loan for it for 5 years. It’s now paid off but I’m never getting another loan for another vehicle. Instead I’m going to save cash and buy my mid life crisis motorbike up front. Good thing I’ve got at least 10 years to save for that mid life crises bike.

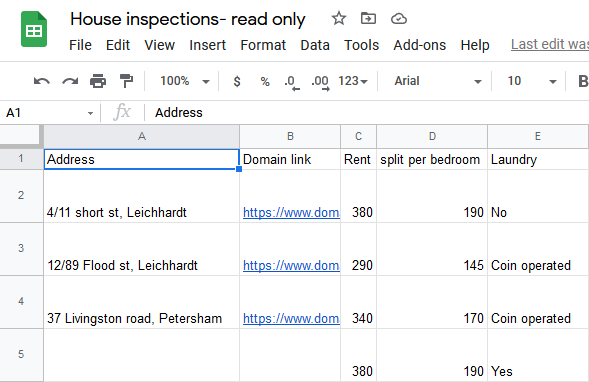

Live in share housing

I live in a 2 bedroom apartment in inner west Sydney. The total rent is $380 per week and I have a house mate I split those costs 50/50 with. So my share of the rent is $190 per week.

This is the cheapest arrangement I’ve had in the 8 years I’ve lived in Sydney. And I’ve lived in some dodgy share rooms with 2 people per room before. I’m a 7 minute walk from the nearest train station and 5km from the city center.

I used this spreadsheet to manage inspections and I’ve used flat mates and Facebook groups to find housemates in the past.

Make things at home

Making sourdough bread at home costs me $2.50 per loaf in ingredients instead of the $9 per loaf I’d pay at my local bakery. I’ve also done my own home brew kombucha and beer too. These can be time consuming to get into but I enjoy the learning process.

I’ve considered making my own cleaning products but I haven’t crossed that bridge just yet. Making coffee at home is cheaper than buying it out every day. I still enjoy a barista made coffee but I try to make one at home too.

Make homemade gifts

I enjoy baking, this year I’m going to consider making my own umami dust and salt rubs as gifts. I’ve done biscuits and and truffles before.

revist annual expenses

Once a year I make sure to generate quotes/shop around for better mobile phone plans and contents insurance. It’s pretty common to get stuck paying the lazy tax if you don’t frequently shop around for better deals.

Earn more

pay down debt

Paying down debt helps you earn more buy giving back more of your income. I paid off my credit card debt this month after 5 years. It was 35K at it’s peak. This has freed up my minimum loan repayments that I can now use to grow wealth.

invest for the long term

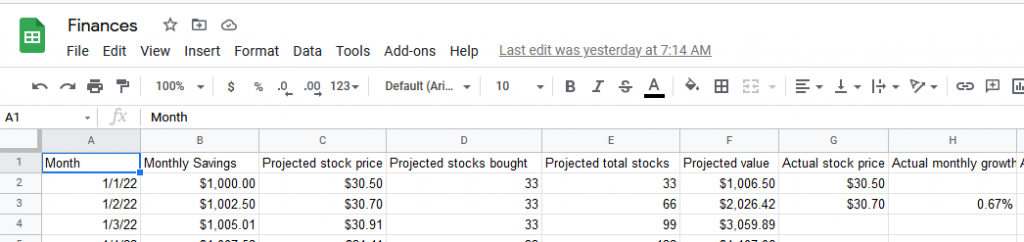

I’ve got this article on investing $1000 a month. Starting in January I’m going to practice what I preach and invest $1000 a month into DHHF and track how that goes in my spreadsheet.

My retirement saving is a big part of my investing for the long term. It is hands down my biggest asset and will remain a big part of my plan. I’m currently maximizing concessional contributions (pre tax) and I’ll be using the first home savers to withdraw 50K in 5 years time.

Keep an eye on the job market

By keeping an eye on the job market I have a clear understanding of what my value is. I’ve kept my CV up to date and have active online profiles. I’ll get contacted by a recruiter once every month or two for a role that matches my skills and pay expectations. It’s nice to feel like my skills are in demand.

It’s also useful to figure out what skills are in demand so that I can increase my earning potential. I’ll be working on some cloud architecture projects next to increase those skills and my marketability.

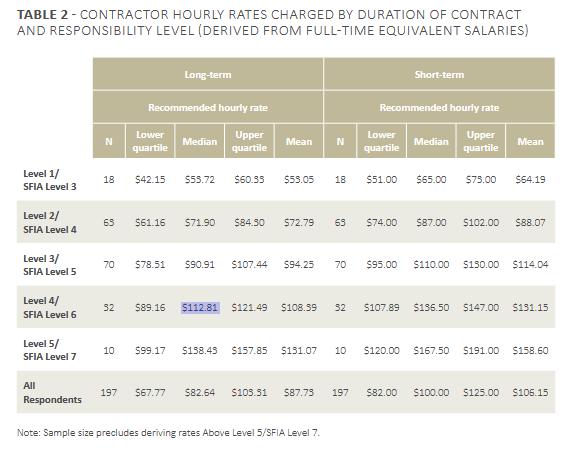

In April I started my business as an IT contractor. The going rate for someone with my skills and experiences is at least $750 per day. I landed a contract that pays me $850 per day and it has helped me on focusing on paying down debt.

Here’s a Talent article on average tech salaries in Sydney and here’s an overview of hourly contracting rates in tech:

Consider other sources of income

I’m working on some passive sources of income. I still need to invest more effort before I see any return on investment but I’m chipping away with YouTube, career coaching, online courses and book writing. I can’t show anything for it yet but it’ll be nice if it builds into something.

Summary

Hopefully that gives you an overview of how I’m growing my wealth overtime. People have a tendency to focus too much on the spending less and I think there are huge potential gains to be made by also increasing your earning potential. I’ve only been able to achieve this by focusing on both sides of wealth creation.

I’m also seeing a financial adviser to help guide me along the path. Even as someone who’s studying financial advice it’s useful to have someone to check in with to make sure I’m on the right path.

If you’d like to read more, I highly recommend passive investing Australia.